Security Alert

Amid the rising concern over fraud attempts through impersonation of reputable institutions, Hong Kong Interbank Clearing Limited (HKICL) and HKICL Services Limited (HSL) would like to remind you to stay alert of any suspicious correspondence appears to be issued by HKICL and/or HSL. In principle, HKICL and/or HSL will only request payments from business partners to whom it has business relationship. HKICL and/or HSL will NOT claim to have statutory/regulatory power to request payments from others. You are advised to contact HKICL and/or HSL upon notice of any suspicious communication.

News in 2026

2026年2月5日

有關偽冒網站的通知

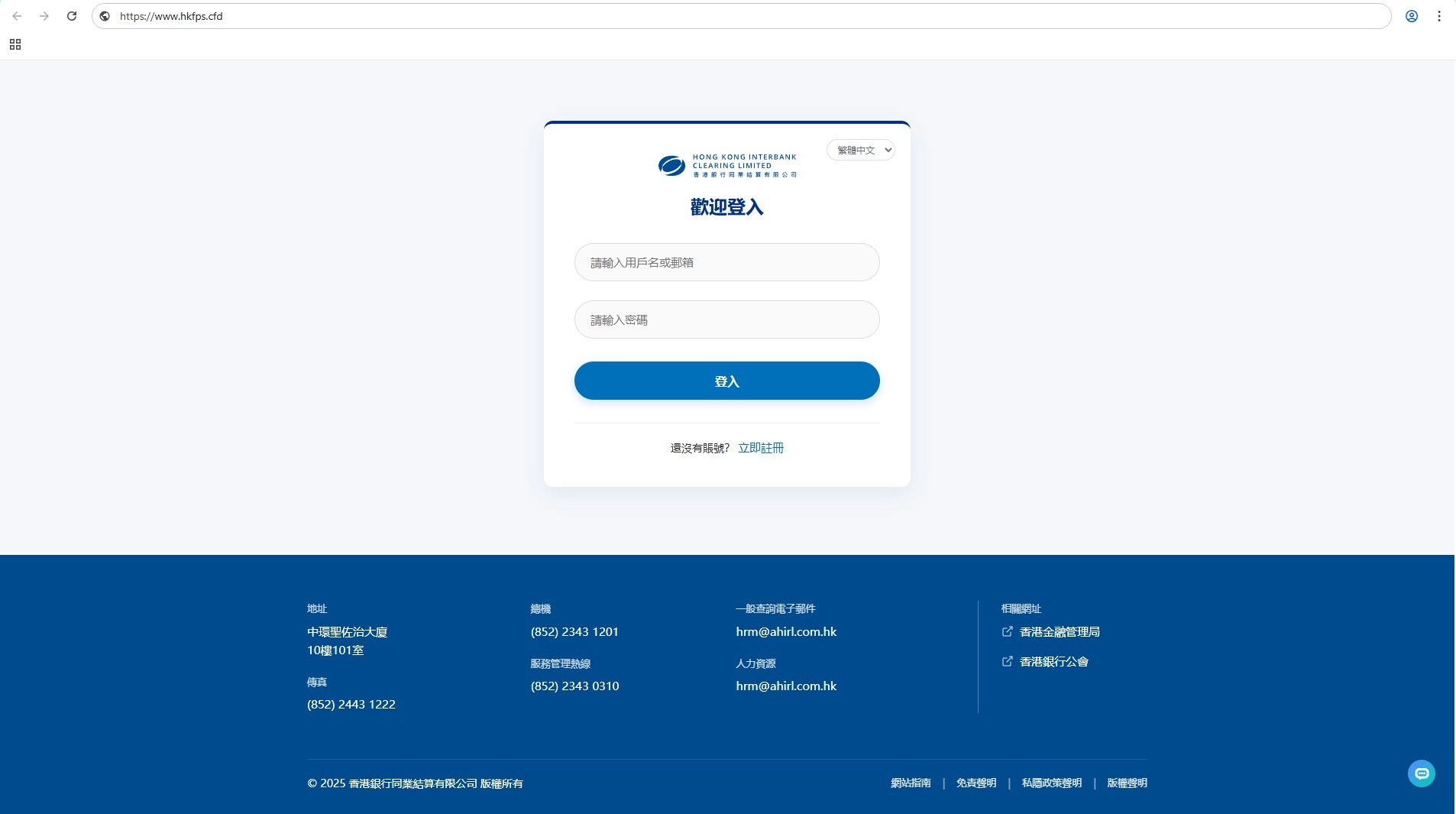

香港銀行同業結算有限公司提示會員及市民慎防冒充本公司的偽冒網站(https://www.hkfps.cfd)。該偽冒網站誘導用戶提供登入資料,並引導用戶與冒充客服的人員進行對話。

在此提醒會員及市民,本公司與此偽冒網站並無任何關係,會員及市民不應連結或提供任何資訊至此偽冒網站。

以下為該偽冒網站的截圖:

本公司提醒會員及市民確保連結至本公司之正確網址,本公司的真正官方網址為https://www.hkicl.com.hk 及 https://fps.hkicl.com.hk。

2026年1月21日

有關偽冒網站的通知

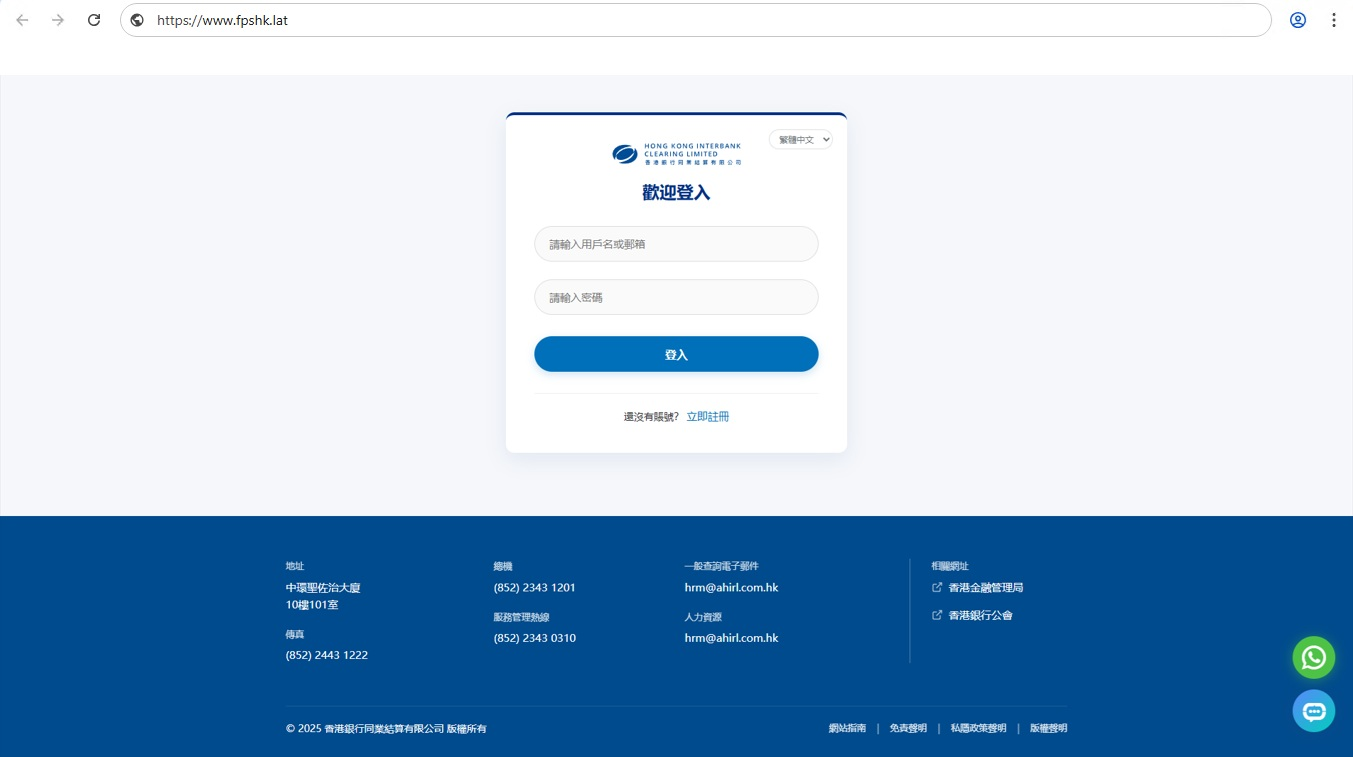

香港銀行同業結算有限公司提示會員及市民慎防冒充本公司的偽冒網站(https://www.fpshk.lat)。該偽冒網站誘導用戶提供登入資料,並引導用戶與冒充客服的人員進行WhatsApp對話。

在此提醒會員及市民,本公司與此偽冒網站並無任何關係,會員及市民不應連結或提供任何資訊至此偽冒網站。 本公司並無設立任何對外之WhatsApp通訊渠道。

以下為該偽冒網站的截圖:

本公司提醒會員及市民確保連結至本公司之正確網址,本公司的網址為https://www.hkicl.com.hk 及 https://fps.hkicl.com.hk。

News in 2025

2025年6月20日

金管局與人民銀行推出「跨境支付通」

香港金融管理局(金管局)及中國人民銀行(人民銀行)今日(6月20日)公布將於2025年6月22日推出「跨境支付通」。今日雙方於北京舉行「跨境支付通」啟動儀式,中國人民銀行行長潘功勝、中央港澳工作辦公室、國務院港澳事務辦公室副主任王靈桂、金管局總裁余偉文出席並致辭,由中國人民銀行副行長陸磊主持。兩地負責營運系統和參與服務的機構代表均有出席。

「跨境支付通」是內地的網上支付跨行清算系統(IBPS)1與香港快速支付系統「轉數快」2的互聯,為兩地居民及機構提供安全、高效和便捷的即時跨境支付服務。兩地居民可以透過輸入收款方的手機號碼或帳戶號碼,進行即時小額跨境匯款。

金管局總裁余偉文表示:「『跨境支付通』是內地與香港合作的重要舉措之一,通過連接兩地快速支付系統實現互聯互通,有效提升跨境支付效率,便利經貿活動和人員往來,有利於鞏固和提升香港國際金融中心及離岸人民幣業務樞紐的地位。『跨境支付通』可以更好滿足兩地居民對跨境匯款和支付的需求,惠及民生所需,亦標誌著香港轉數快在拓展跨境支付方面取得進一步成果。」

「跨境支付通」推出初期,兩地分別有六家參與機構(附件),服務會陸續推出並逐步加入更多參與機構。

中國人民銀行行長潘功勝(中),中央港澳工作辦公室、國務院港澳事務辦公室副主任王靈桂(右二),中國人民銀行副行長陸磊(右一),香港金融管理局總裁余偉文(左二)以及中國銀行行長張輝(左一)今日出席「跨境支付通」的啟動儀式。

中國人民銀行行長潘功勝於啟動儀式上致辭。

中央港澳工作辦公室、國務院港澳事務辦公室副主任王靈桂於啟動儀式上致辭。

香港金融管理局總裁余偉文於啟動儀式上致辭。

香港參與機構的管理層出席啟動儀式。

1 內地網上支付跨行清算系統(IBPS),是由中國人民銀行指導清算總中心建成的內地快速支付系統,支持用戶通過開戶銀行的手機銀行、網上銀行辦理實時跨行零售支付業務。使用者可通過系統足不出戶辦理跨行帳戶管理、資金匯劃、資金歸集等業務,並可即時獲取業務處理結果。

2 金管局於2018年9月推出快速支付系統「轉數快」,系統連接銀行及儲值支付工具營運商,讓市民可以隨時隨地利用收款人的手機號碼或電郵地址,進行跨行即時資金轉帳。

資料來源: 香港金融管理局新聞稿 (請按此)。

News in 2023

2023年9月26日

「轉數快x中小企」研討會及轉數快五周年

香港金融管理局(金管局)今天(9月26日)舉辦了「轉數快x中小企」研討會,共吸引了超過130位中小企業、商會、銀行及儲值支付工具營運商的代表參與。是次研討會主題為「轉數快x中小企:同創新‧增效益‧拓商機」,以促進業界與中小企的交流,探討轉數快在中小企支付領域的重要性和發展機遇。

金管局副總裁李達志致歡迎辭時表示:「今年9月是轉數快推出五周年,我們見證着轉數快在個人對個人支付的迅速發展,並廣受市民歡迎。我們期望轉數快的使用能夠推進至另一個里程碑,在企業層面獲更廣泛使用。中小企是香港經濟的重要一環,在構建香港國際金融中心上扮演重要角色。我們希望透過促進中小企採用轉數快,增強它們的競爭力,並協助它們融入電子支付的時代,這也是金管局推動普及金融的目標之一。」

研討會的專題討論環節探討了中小企業在應用轉數快時的挑戰,及銀行如何提供不同的轉數快收付方案,以協助中小企業採用電子支付。另外,研討會亦邀請了兩間中小企業,分享它們使用轉數快提升公司營運效率及減省行政工作的經驗,以及轉數快即時到帳的特性如何增加公司的現金流,令資金調撥更靈活。

轉數快推出五周年,金管局聯同21間銀行及儲值支付工具營運商(附件一)推出了不同優惠予企業及個人客戶,其中九間銀行及儲值支付工具營運商今天於研討會現場設置展覽,即場介紹轉數快收付方案及提供優惠予中小企客戶。負責營運轉數快的香港銀行同業結算有限公司亦會於今年10月豁免銀行及儲值支付工具營運商在處理企業及商戶經轉數快作即時收付的結算費用,以鼓勵它們回饋中小企業及商戶,吸引更多企業採用轉數快,實現同創新、增效益及拓商機的目標。

另外,李達志在研討會上提及,金管局與泰國央行的合作取得成果,轉數快與泰國「PromptPay」互聯的計劃預期於今年底前推出,屆時香港居民可以在泰國使用轉數快進行零售支付,而泰國旅客亦可在香港使用泰國的快速支付系統「PromptPay」付款給香港商戶,為兩地旅客提供多一個安全便捷的支付選擇及嶄新的支付體驗。

轉數快於今年8月錄得1,281萬個帳戶登記,平均每年增長36%。轉數快的使用量亦持續上升,每日港元即時交易量及交易金額,於過去五年平均每年增長分別達71%及41%。今年8月,轉數快平均每天處理125萬宗港元即時交易,相當於99億港元。

香港金融管理局副總裁李達志在「轉數快x中小企」研討會上致歡迎辭。

香港金融管理局(金管局)副總裁李達志(前排左三)、金管局助理總裁(金融基建)鮑克運(前排左二)、香港銀行同業結算有限公司行政總裁鄧月容(前排右二),以及參與展覽的銀行及儲值支付工具營運商代表出席研討會。

(左起)研討會的專題討論由香港金融管理局助理總裁(金融基建)鮑克運主持,並邀請了香港上海滙豐銀行有限公司常務總監兼中小企業務策略及創新主管劉囅鋒、中國銀行(香港)有限公司工商金融部助理總經理劉浩勤及香港總商會中小型企業委員會副主席蘇裕康博士參與討論。

兩間中小企業代表,曲奇阿嬸聯合創辦人馮思樺(右二)及FreightAmigo聯合首席執行官兼創辦人謝凱澄(右一),在研討會上分享她們使用轉數快的體驗。此環節由香港銀行同業結算有限公司行政總裁鄧月容主持(左一)。

香港金融管理局(金管局)副總裁李達志(左二)、金管局助理總裁(金融基建)鮑克運(左一)及香港銀行同業結算有限公司行政總裁鄧月容(右一)參觀銀行及儲值支付工具營運商於研討會現場設置的展覧。

研討會共吸引了超過130位中小企業、商會、銀行及儲值支付工具營運商的代表參與。

資料來源: 香港金融管理局新聞稿 (請按此)。

News in 2022

金管局歡迎信貸資料平台開始運作

香港金融管理局(金管局)歡迎香港銀行公會、香港有限制牌照銀行及接受存款公司公會和香港持牌放債人公會(統稱「行業公會」)今日(11月28日)有關信貸資料平台開始運作的聯合公告。

金管局一直與行業公會緊密合作,透過信貸資料平台引入多於一家個人信貸資料服務機構,以提升香港個人信貸資料服務機構的服務水平,並減低現時因市場只有一家商業營運的服務提供者而衍生的營運風險,特別是單點失誤的風險。

作爲「金融科技2025」策略下發揮數據基建潛能和推動香港金融科技發展的一項重要舉措,多家個人信貸資料服務機構模式的發展獲金管局的全力支持。金管局衷心感謝行業公會、平台營運機構、平台服務支援方及其他持份者為推出信貸資料平台和落實多家個人信貸資料服務機構模式付出巨大的努力。

信貸資料平台於今日開始運作後,參與平台的信貸提供者會陸續將個人信貸資料上載到信貸資料平台。其後,獲選信貸資料服務機構會從信貸資料平台下載這些資料以準備提供個人信貸資料服務。

請按此閱讀香港金融管理局的新聞稿。

金管局正式推出「商業數據通」

香港金融管理局(金管局)今日(10月24日)宣布正式推出「商業數據通」。「商業數據通」是金管局「金融科技2025」策略的重點舉措之一,旨在提升香港的數據基建,並締造可安全及順暢地互換數據的生態圈。

「商業數據通」作為一項以數據擁有人授權為本的數據基建,旨在便利金融機構從公私營數據提供方提取企業(尤其是中小型企業)的商業數據,促進數據共享。隨着「商業數據通」正式投入運作,金融機構可採納更多創新應用,以數碼化和簡化「認識你的客戶」、信貸評估、貸款批核及風險管理等一連串融資流程。

「商業數據通」試行期間,參與銀行合共批出了逾16億港元的中小企貸款,體現了替代數據可帶來的效用,並成功吸引23家積極從事中小企業務的銀行(詳見附件)及10間數據提供方參與。當中,六間擁有大量中小企數據的主要數據提供方已率先加入「商業數據通」,將會讓銀行在企業同意下通過「商業數據通」獲取數據。現階段涉及的商業數據涵蓋電子貿易報關、電子商貿、供應鏈、支付及信貸紀錄等資料。

為確保所有參與「商業數據通」的機構均遵守同一套規則,進行適切、公平及安全的商業數據互換,金管局今日亦公布了《商業數據通管治框架》,詳細列明管治模式及架構。

金管局鼓勵中小企聯絡參與銀行,以進一步了解銀行透過「商業數據通」提供的嶄新金融服務。詳情亦可參閱「商業數據通」網頁。

展望未來,金管局會繼續研究如何擴闊「商業數據通」的數據範圍,包括加入政府部門及分析服務供應商的數據,以發展出更多與「商業數據通」相關的新商業用例。

金管局副總裁李達志表示:「有賴銀行及不同界別的數據提供方的全力支持,『商業數據通』歷經兩年發展里程,從構思演化為試行項目,最終蛻變成投入運作的基建,為此我們深感喜悅。今日『商業數據通』正式推出,邁進數據共享的新紀元。我們深信『商業數據通』將發揮關鍵作用,推動銀行與數據提供方的多邊數據共享,促進金融創新。」

請按此閱讀香港金融管理局的新聞稿。

News in 2021

Delivery versus Payment (DvP) Linkage with Bank of Japan

A new DvP link initiated by the HKMA and Bank of Japan for cross-currency securities transactions between the HKD payment system (CHATS) and the Bank of Japan Financial Network System for Japanese Government Bond (BOJ-NET JGB) Services was launched on 1 April 2021. This new link facilitates DvP settlement of the HKD sale and repurchase (repo) transactions using Japanese Government Bonds (JGB) as collateral and helps eliminate settlement risk by ensuring simultaneous delivery of HK dollars in Hong Kong and JGBs in Japan.

News in 2019

積金局與香港銀行同業結算有限公司合作研究積金易平台電子結算和支付系統

積金局與香港銀行同業結算有限公司(結算公司)於今天(12月10日)簽訂合作協議,共同探討適用於積金易平台的電子結算和支付系統。

在積金局機構事務總監及執行董事鄭恩賜先生、積金局營運總監及執行董事朱擎知先生、香港金融管理局(金管局)高級助理總裁劉應彬先生及金管局助理總裁(金融基建)鮑克運先生的見證下,積金局執行董事(成員)許慧儀女士和結算公司行政總裁鄧月容女士代表雙方簽署了諒解備忘錄。

朱擎知先生表示:「構建積金易平台的其中一個目的,是提高僱主和計劃成員管理強積金的效率及用家經驗,而無縫、安全可靠的電子支付系統,將會是積金易平台不可缺少的部份。」

許慧儀女士表示:「結算公司成功開發轉數快、電子支票、強積金轉移電子化支付等電子支付系統。憑藉結算公司豐富經驗和知識,將有助我們為積金易平台開發適合而高效的電子結算和支付系統,以處理將來積金易平台龐大的強積金供款和交易。」

劉應彬先生表示:「是次簽訂合作協議,標誌著雙方同意共同推動香港金融基建的發展,以進一步提升處理支付交易的效能。我很高興轉數快在推出短短一年時間已經被廣泛使用,並由個人對個人支付逐步發展至企業支付。憑藉我們開發這個高效且穩健的電子支付平台的經驗,我相信這將有助於推動積金易平台的發展,並為有關平台提供多元化及創新的支付方案。金管局會繼續致力探討更多轉數快的應用場景,進一步促進香港電子支付生態的發展。」

鄧月容女士表示:「轉數快與積金易平台皆致力為市民大眾提供高效及可靠的24x7電子服務。憑藉開發轉數快及其他電子系統的成功經驗,結算公司有信心其安全可靠的支付技術有助積金局發展一個不單以用家為本、更可為香港金融基建發展作出供獻的積金易平台。」

在積金局機構事務總監及執行董事鄭恩賜(左二)、積金局營運總監及執行董事朱擎知(左一)、金管局高級助理總裁劉應彬(右二)及金管局助理總裁(金融基建)鮑克運(右一)的見證下,積金局執行董事(成員)許慧儀(左三)和結算公司行政總裁鄧月容(右三)代表雙方簽署了諒解備忘錄,共同探討適用於積金易平台的電子結算和支付系統。

News in 2018

「轉數快」開通儀式

請按此閱讀香港金融管理局的新聞稿。

請按此閱讀香港政府新聞網的新聞稿。

Faster Payment System (“FPS”)

Faster Payment System (FPS) is launched on 17 September 2018. The FPS is a payment financial infrastructure introduced by the Hong Kong Monetary Authority (HKMA) and operated by Hong Kong Interbank Clearing Limited (HKICL) to enable real-time fund transfer and payment services among banks and payment service providers (including stored value facilities (SVFs) licensed by and retail payment systems (RPS) designated by the HKMA). This real-time payment platform enables instant payments in Hong Kong, providing consumers and merchants a safe, efficient and widely accessible retail payment service on a 7x24 basis.

Please click here to read the press release from the Hong Kong Monetary Authority.

News in 2017

Extension of Central Clearing and Settlement System (CCASS) Real-time Delivery versus Payment (RDvP) Settlement Window

To facilitate the usage of CCASS RDvP service by the China Connect Markets, the Hong Kong Securities Clearing Company Limited (HKSCC) has extended the settlement window for CCASS RDvP Payments with effect from 20 November 2017. The new settlement window operates between 09:15 and 18:00 hours for HKD and USD currencies and between 09:15 and 19:45 hours for RMB currency, excluding Hong Kong general holidays on which CCASS will not be operated. The corresponding schedule for CCASS cutoff events has also been revised in view of this extension, with an additional CCASS interim cut-off at 15:30.

News in 2016

Enhancements for RMB FINInform Payment

As part of the continuous drive to promote efficiency and flexibility, user interface functions are provided for Global Users to enquire their transaction status, account debit limit and reference balance through the new iMBT channel over internet and/or existing eMBT channel via SWIFT network, with effect from 21 November 2016.

Sanction Screening of USD CHATS Payments by HSBC Sanction Screening System (“HSSS”)

USD CHATS has been enhanced to interface with the HSBC Sanction Screening System, replacing the Centralised Payment Filter, with effect from 1 August 2016 to provide corresponding payment sanction screening capabilities

Hong Kong-Guangdong Province (including Shenzhen) One-Way Joint Clearing for HKD, USD and RMB e-Cheque and Hong Kong-Guangdong Province One-Way Joint Clearing for USD Paper Cheque

A new one-way Hong Kong-Guangdong and Hong Kong-Shenzhen cross-border e-Cheque clearing service of HKD, USD and RMB e-Cheques is launched on 20 July 2016. The cross-border e-Cheque links are implemented to facilitate efficient processing of e-Cheque clearing between Guangdong Province (including Shenzhen) and Hong Kong. Through the joint clearing arrangement, payees in Guangdong Province (including Shenzhen) can present e-Cheques drawn on banks in Hong Kong to banks within Guangdong Province (including Shenzhen) for further clearing and settlement in Hong Kong by HKICL.

While the Hong Kong-Shenzhen joint clearing for USD paper cheque was already implemented in 2004, we have taken this opportunity to implement the Hong Kong-Guangdong Province one-way joint clearing for USD paper cheque on the same date (i.e. 20 July 2016).

Same Day CCASS Night Settlement (“SCASSN”)

A new Renminbi same day settlement run in late evening for CCASS items is introduced on 18 April 2016. It serves to mitigate the overnight counterparty risk that may arise between investors and brokers in connection with the settlement instructions relating to securities listed in Mainland China. The Central Clearing and Settlement System generates the relevant items and submits to HKICL by Hong Kong Securities Clearing Company Limited for settlement on the same day.

Interbank Intraday Liquidity Facility

A new Interbank Intraday Liquidity Facility function is introduced in HKD CHATS, USD CHATS, RMB CHATS and Euro CHATS on 18 January 2016. It serves to enhance efficiency of the liquidity provision mechanism between Liquidity Provider(s) and its registered Liquidity Consumer(s) in respective CHATS.

News in 2015

Electronic Cheque (“e-Cheque”) Service

The e-Cheque service, launched on 7 December 2015, is an integrated presentment, clearing and settlement platform to facilitate (i) payee to present e-Cheques (including e-Cashier’s Orders) to its bank through presentment channels such as internet banking system provided by the payee’s bank or the e-Cheque Drop Box Service provided by HKICL; and (ii) clearing and settlement of e-Cheque payments. Under the e-Cheque service, both the payer and payee can execute timely payments enabled by electronic means.

RMB FINInform Payments

A new payment function is introduced in RMB CHATS on 14 September 2015 allowing Direct Participants (DPs) to act as settlement banks for registered indirect users, namely Global Users (GUs), where the GUs can exchange RMB payment messages via SWIFT’s FINInform Y-copy service for the account of their respective DPs, thus enhancing straight-through-processing, efficiency and transparency of RMB RTGS payment processing.

Extension of Renminbi ("RMB") CHATS and Central Moneymarkets Unit Processor (“CMUP”) Operating Window

With further rising demand for RMB clearing service around the world and to further strengthen Hong Kong’s offshore RMB market, the Hong Kong Monetary Authority and RMB Clearing Bank have approved an extension of the RMB CHATS operating hours from the current window between 08:30 hours and 23:30 hours (the bank cut-off time), to between 08:30 hours and 05:00 hours (the bank cut-off time) of the next calendar day on all weekdays except 1 January starting from Monday, 20 July 2015. RMB CHATS will also open between 08:30 hours and 18:30 hours (the bank cut-off time) on special Saturdays and Sundays which are designated as working days in Mainland China. To facilitate RMB clearing members to better manage their RMB liquidity, the daily closing time of CMUP has also been extended from 23:30 hours to 05:00 hours of the next calendar day to align with the operation schedule of RMB CHATS on all weekdays.

News in 2014

Monthly Intraday Liquidity Monitoring Report

To facilitate Member’s management of intraday liquidity, a new Monthly Intraday Liquidity Monitoring Report was introduced to CHATS of all four clearing currencies on 17 November 2014. This new report facilitates Members to monitor their intraday liquidity usage and positions arising from CHATS activities.

Payment-versus-Payment Settlement for US Dollar ("USD") and Thai Baht ("THB")

A new cross-border payment-versus-payment (PvP) link between the USD CHATS and the BAHTNET system (Bank of Thailand’s Thai Baht RTGS system) for settlement of USD/THB foreign exchange transactions was launched on 28 July 2014. This new link facilitates PvP settlement of USD/THB foreign exchange transactions by eliminating settlement risk for the banking institutions in Hong Kong and Thailand.

Mandatory Provident Fund (MPF) Money Settlement Service

To enhance the efficiency of MPF funds settlement among trustees arising from investor portfolio transfers, the HKMA and Mandatory Provident Fund Schemes Authority have jointly introduced money settlement for MPF funds transfer (“MPF Money Settlement Service”) under the Central Moneymarkets Unit (“CMU”) of the HKMA with effect from 19 May 2014.

All MPF trustees in Hong Kong will participate as CMU members and engage settlement banks who are Members of the Clearing House to carry out money settlement on their behalf in the new MPF bulk settlement run in the HKD clearing system.

News in 2013

Electronic Bill Presentment and Payment (EBPP)

EBPP, a platform established by the joint effort of Hong Kong’s banking industry, provides a single consolidated platform that enables the general public to receive and pay bills, or to make donations and receive donation receipts via their internet banking systems. Effective from 18 November 2013, participating banks can exchange merchant, enrolment, bill presentment and donation receipt information through this centralised service. In addition, bill related payments and donations in HKD, USD or RMB can be settled via the corresponding clearing and settlement service.

Delivery versus Payment Link with Euroclear Bank

To facilitate cross-border collateralised lending and borrowing, the delivery versus payment (DvP) facilities of CHATS is extended to securities transactions settled in Euroclear Bank effective 17 June 2013. A linkage between the CHATS of HKICL and global tripartite repo system of Euroclear Bank is established for supporting DvP settlement of the transfer of collateralised securities in Euroclear Bank and the transfer of funds in CHATS simultaneously.

Alphanumeric Clearing Code

Effective 18 March 2013, three-digit alphanumeric clearing codes will be introduced for overseas direct participants (“DPs”) of USD Clearing, Euro Clearing and RMB Clearing, so as to save the usage of the current three-digit numeric clearing codes for local clearing member. Alphanumeric clearing codes will be assigned to overseas DPs that do not participate in bulk clearing and CCASS money settlement services (including paper cheque clearing, CCASS and other electronic clearing service, and/or CCASS real-time DvP service).

HKICL Network (ICLNet)

ICLNet, a secure, open, scalable, and high performance restricted-access private IP-based network for connecting the respective computer systems of the financial institutions and other licensed financial entities in Hong Kong to exchange electronic data efficiently and in a secure manner, commenced operations on 18 March 2013.

News in 2012

Dual Sites Operations

HKICL relocated its production clearing centre, data centre and main office from Hong Kong Island to Kowloon on 17 December 2012. The Hong Kong Island offices were converted into the Company’s backup clearing and data centre at the same time. With a view to providing better clearing service and bringing convenience to Members after HKICL’s relocation, clearing counter services are provided at both Hong Kong Island and Kowloon centres (Dual Sites Operations) to facilitate Members’ outward submission and inward collection of clearing/returned items.

Cross-border Autodebit Service between Guangdong (“GD”) and Hong Kong (“HK”) using China UnionPay HKD/RMB Debit Cards and Direct Debit RMB Account

Following the launch of the cross-border autodebit service between Shenzhen and HK that enables customers in Hong Kong to make autodebit payments to merchants such as utility companies, telephone operators, estate management companies, etc. in Shenzhen, China, this service has been extended to cover Guangdong province starting from 16 July 2012. This service provides greater convenience to customers in Hong Kong, who can make payments by debiting their China UnionPay HKD/RMB debit cards, or RMB bank accounts in Hong Kong to eligible merchants in the Guangdong Province.

Extension of Renminbi ("RMB") CHATS and Central Moneymarkets Unit Processor ("CMUP") Operating Window

To strengthen Hong Kong’s capability in settling overseas RMB payments, the Hong Kong Monetary Authority and RMB Clearing Bank have approved an extension of the RMB CHATS operating hours from the current window between 08:30 hours and 18:30 hours (the bank cut-off time), to between 08:30 hours and 23:30 hours (the bank cut-off time) on all weekdays except 1 January effective Monday, 25 June 2012. To facilitate RMB clearing members to better manage their RMB liquidity, the daily closing time of CMUP has also been extended from 18:30 hours to 23:30 hours to align with the operation schedule of RMB CHATS.

News in 2011

RMB EPS and RMB Same Day Settlement EPS

As a continuous expansion of the RMB business in Hong Kong, we have launched the new RMB EPS and RMB Same Day Settlement services on 21 November 2011. These services facilitate the clearing and settlement of retail payment transactions of the participating merchants of EPSCO in RMB currency.

CCASS T+2 Money Settlement Service ("Service")

The Service was launched on 25 July 2011. Under the new arrangement, the overnight credit risk arising from the settlement gap between stock and money is minimized since the securities trades settled by the Central Clearing and Settlement System operated by Hong Kong Securities Clearing Company Limited and the interbank money settlement for these trades via HKICL would be done on the same day.

Renminbi ("RMB") Autopay and RMB Special CCASS Items

To support the expansion of RMB business in Hong Kong, we have launched a new RMB Autodebit and Autocredit service on 21 March 2011. Furthermore, to facilitate the timely clearing and settlement of RMB Initial Public Offering refund, a new bulk clearing service for RMB Special CCASS items was introduced also on the said date.

News in 2010

Regional CHATS Payment Service (“RCPS”)

To sustain Hong Kong’s status as a regional hub and to cope with the expansion of local Renminbi (“RMB”) business, the RCPS has been enhanced to include RMB in addition to the original 3 currencies, i.e. HKD, USD and Euro. This additional service is available since 20 December 2010. RCPS service providers who wish to provide RMB RCPS can subscribe this enhanced service with HKICL.

Same Day Settlement JETCO Items

This new service launched on 20 September 2010 allows the members of Joint Electronic Teller Services Limited (“JETCO”) an option to enjoy earlier funds availability as the interbank payments initiated by JETCO are settled within the same day of submission. The existing settlement on the working day after submission remains unchanged.

Same Day Settlement EPS Items

This new service launched on 20 September 2010 allows the participating merchants of Easy Payment System (“EPS”) an option to enjoy earlier funds availability as the settlement of the EPS items submitted to HKICL by Easy Payment System Company (Hong Kong) Limited is done within the same day of submission. The existing settlement on the working day after submission remains unchanged.

Cross-border Autodebit Service Using China UnionPay HKD Debit Cards

In view of the frequent economic interaction between Hong Kong and Shenzhen, we have launched a Cross-border Autodebit Service jointly with China UnionPay (“CUP”) and Shenzhen Financial Electronic Settlement Centre on 27 September 2010. This service facilitates payment made by debtors in Hong Kong to merchants in Shenzhen using CUP HKD Debit Card.

Browser-based RTGS front-end applications on SWIFTNet and Internet

The front-end terminal applications of the RTGS systems were successfully migrated from the text-based MBT/400 and CMT/400 to browser-based applications on 12 July 2010. After the migration, eMBT via SWIFTNet is the front-end terminal application of CHATS of all clearing currencies, while eCMT via SWIFTNet and iCMT via the Internet are the front-end terminal applications of the HKMA's CMU. The new eMBT, eCMT and iCMT are user friendly applications that improve the users’ operations in addition to the enhanced system functionalities.

Payment-versus-Payment Settlement for US Dollar ("USD") and Indonesian Rupiah ("IDR")

A new payment system linkage between the USD CHATS and the BI-RTGS System (Bank Indonesia's RTGS system) for payment-versus-payment (“PvP”) settlement of USD/IDR foreign exchange transactions was launched on 25 January 2010. This new payment systems linkage facilitates PvP settlement of USD/IDR foreign exchange transactions as a measure to eliminate settlement risk for the banking institutions in Hong Kong and Indonesia.

News in 2009

The establishment of cross-border links with the clearing and settlement systems of other Asian countries will help developing Hong Kong into a payment and settlement hub for the region. Following the successful linkage of USD CHATS with RENTAS (a real time electronic transfer of funds and securities system) in Malaysia to facilitate the real time payment versus payment transactions of USD/Malaysian Ringgit, and the settlement in Hong Kong of the cash leg of the real time delivery versus payment transactions of USD bonds traded in Malaysia, a cross border link for fund transfers between Hong Kong’s RTGS systems and the Mainland’s foreign currency RTGS systems was launched on 16 March 2009. This cross border link facilitates 2-way real-time USD, HKD and Euro funds transfers between banks in Hong Kong and banks participating in the RTGS systems of the respective currencies in the Mainland. A list of the banks in Mainland that participate in the cross border link can be found on HKICL website.

Effective 25 May 2009, the RTGS systems of all clearing currencies are able to support payment transactions transmitted in SWIFT message format.

News in 2008

Effective 23 June 2008, in addition to HKD cheques, USD cheques drawn on banks in Macau and presented by banks in Hong Kong can be settled on the following working day.

The RTGS operating hours were extended by one hour from 17:30 hours to 18:30 hours, Mondays to Fridays except General Holidays, effective 3 November 2008 in order to allow banks in Hong Kong that have business with the Mainland and western Asian countries more time to process their remittance payments which in turn could enhance their services and help developing Hong Kong as a regional payment HUB to serve the neighbour countries in the region.

A new clearing service to enhance the refund process of the electronic initial public offering (“eIPO”) of the Central Clearing and Settlement System (“CCASS”) was launched on 15 December 2008. Under this new service, the inter-bank settlement of the eIPO refund monies is performed on the refund day so that the CCASS participants can receive the refund monies in good funds on the same day instead of previously on the working day following the refund day. .

News in 2007

The Regional CHATS Payment Services was launched in July 2007 which linked all participants of the existing HKD, USD and Euro RTGS systems in Hong Kong in order to build an extensive correspondent network to facilitate the cross-border payments through the RTGS systems in Hong Kong during Asian business hours.

To support the clearing and settlement of the RMB-denominated transactions in Hong Kong, a full-fledged Renminbi RTGS system, and the RMB local cheque clearing were introduced on 18 June 2007.

The one-way clearing for HKD cheques drawn on banks in Hong Kong and presented by banks in Macau was introduced in August 2007 to reduce the time taken for Macau residents to receive funds.

The linkage between Hong Kong’s USD RTGS Systems and Malaysia’s Rentas Scriptless Securities Trading System for delivery-versus-payment settlement of USD bonds in Malaysia was introduced on 12 November 2007. This linkage eliminates settlement risk of USD bonds issued and traded in Malaysia by ensuring simultaneous delivery of US dollars in Hong Kong and USD bonds in Malaysia.

The opening of the RTGS settlement window was advanced by 30 minutes from 09:00 hours to 08:30 hours with effect from 3 December 2007 in order to allow banks more time for the settlement of CCASS related payments given the booming stock market, which in turn helps banks to better manage their liquidity for the settlement of CCASS items.

News in 2006

Payment versus Payment (PvP) Settlement for USD and Malaysian Ringgit (MYR)

The Hong Kong Monetary Authority and Bank Negara Malaysia (BNM), the Central Bank of Malaysia has agreed to establish a link between the Ringgit real-time gross settlement system in Malaysia (the RENTAS system) and the USD real-time gross settlement system in Hong Kong (USD RTGS system). This payment link enables the reduction of foreign exchange settlement risk through the implementation of a PvP mechanism during the Malaysia and Hong Kong business hours, and helps to increase the efficiency and safety of payment systems in Malaysia and in the region, in particular to manage FX settlement risk exposure for the FX transactions involving the US dollar and MYR.

This new system was launched on 13 November 2006.

Renminbi Settlement System

HKICL has been engaged by Bank of China (Hong Kong) Limited, the Clearing Bank ("CB") for RMB business in Hong Kong, to develop a Renminbi Settlement System ("RSS") that provides participants of this system with RMB cheque clearing service, and real-time RMB payment services including RMB position-squaring, remittance processing, and RMB bank card payment.

Licensed banks in Hong Kong, as well as their credit card subsidiaries can join the RSS with the permission from the CB and the HKMA, and each participant has to maintain a settlement account with the CB. The RSS is launched on 6 March 2006.