Security Alert

Amid the rising concern over fraud attempts through impersonation of reputable institutions, Hong Kong Interbank Clearing Limited (HKICL) and HKICL Services Limited (HSL) would like to remind you to stay alert of any suspicious correspondence appears to be issued by HKICL and/or HSL. In principle, HKICL and/or HSL will only request payments from business partners to whom it has business relationship. HKICL and/or HSL will NOT claim to have statutory/regulatory power to request payments from others. You are advised to contact HKICL and/or HSL upon notice of any suspicious communication.

News in 2026

February 5, 2026

Notification of Fraudulent Website

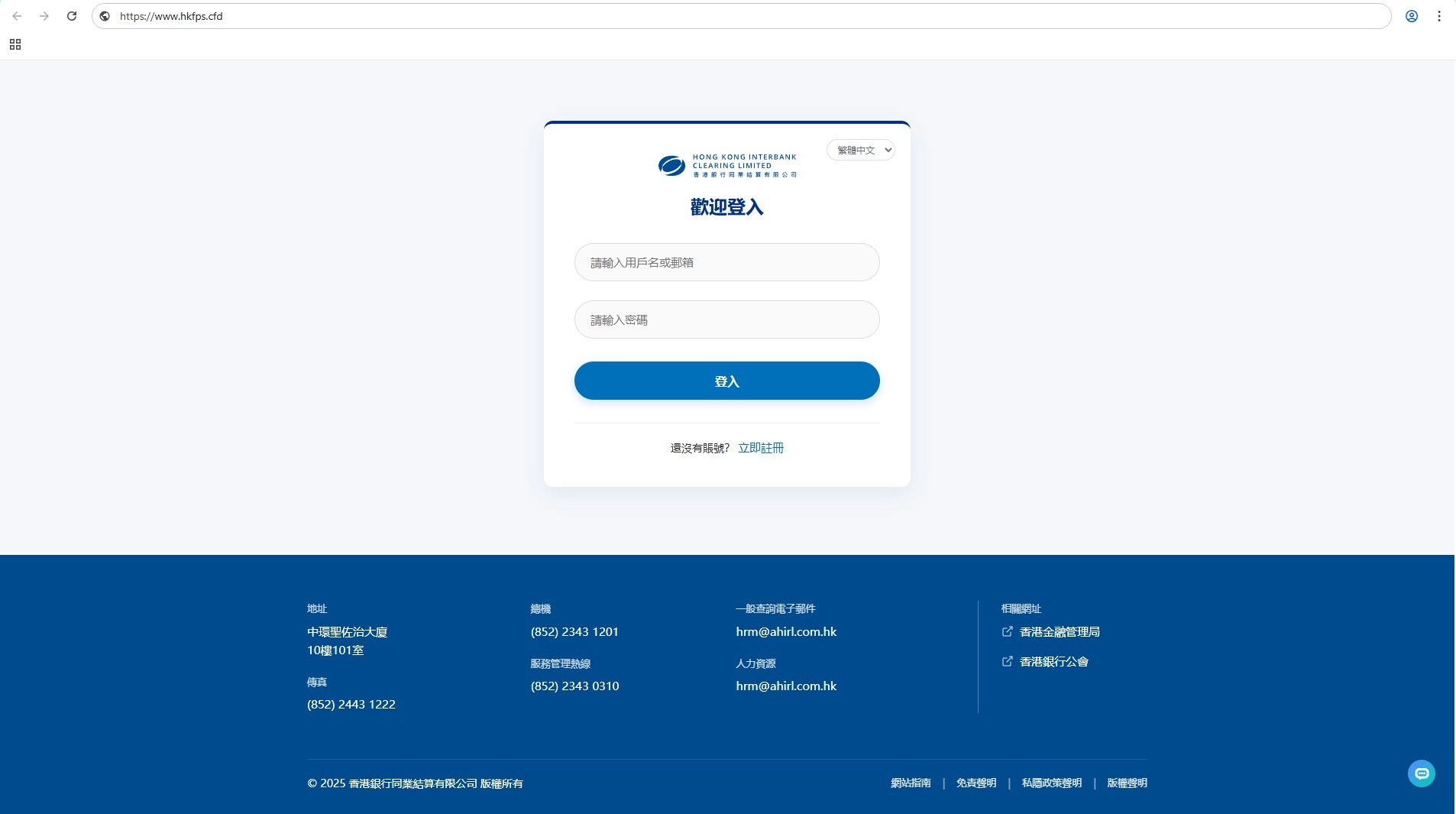

Hong Kong Interbank Clearing Limited (HKICL) would like to alert its members and the public to a fraudulent website (https://www.hkfps.cfd) purported to be from HKICL. The fraudulent website tricks user into giving away login credentials or directs user to a fraudster impersonating as customer service personnel.

HKICL would like to remind its members and the public that it has no connection with the fraudulent website involved. Please be advised not to access nor provide any information on this fraudulent site.

Below is the screen capture of the fraudulent website:

Please also be reminded to ensure you are connected to the valid HKICL sites. The genuine official website addresses are https://www.hkicl.com.hk and https://fps.hkicl.com.hk.

January 21, 2026

Notification of Fraudulent Website

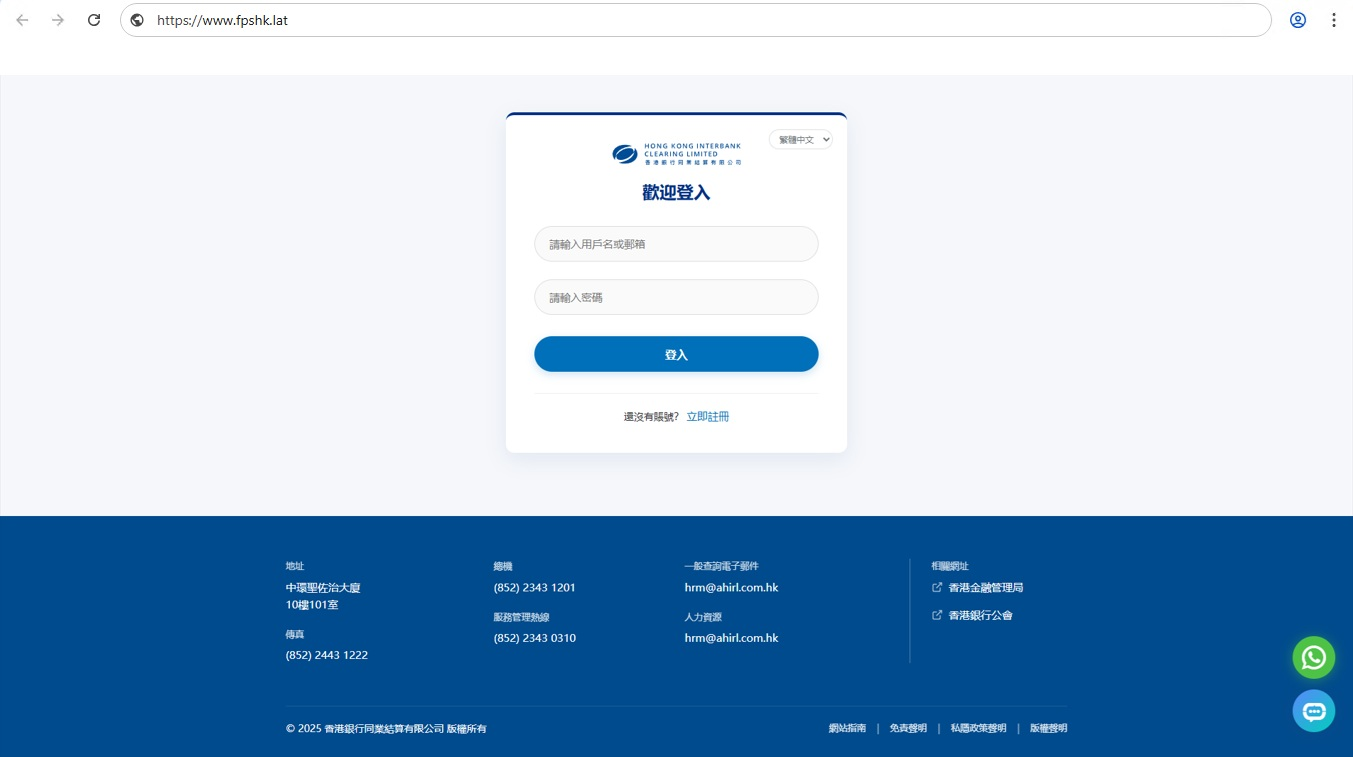

Hong Kong Interbank Clearing Limited (HKICL) would like to alert its members and the public to a fraudulent website (https://www.fpshk.lat) purported to be from HKICL. Moreover, the fraudulent website tricks user into giving away login credentials or directs user to a WhatsApp chats with the fraudster impersonating as customer service personnel.

HKICL would like to remind its members and the public that it has no connection with the fraudulent website involved. Please be advised not to access nor provide any information on this fraudulent site. HKICL does not set up any WhatsApp channel for external communication.

Below is the screen capture of the fraudulent website:

Please also be reminded to ensure you are connected to the valid HKICL sites. The valid website addresses are https://www.hkicl.com.hk and https://fps.hkicl.com.hk.

News in 2025

June 20, 2025

The HKMA and the PBoC Launch Payment Connect

The Hong Kong Monetary Authority (HKMA) and the People’s Bank of China (PBoC) announced today (20 June) the launch of Payment Connect on 22 June 2025. A launch ceremony for Payment Connect was held in Beijing today. Mr Pan Gongsheng, Governor of the PBoC, Mr Wang Linggui, Deputy Director of the Hong Kong and Macao Work Office of the Communist Party of China Central Committee and the Hong Kong and Macao Affairs Office of the State Council, and Mr Eddie Yue, Chief Executive of the HKMA, attended the ceremony and delivered remarks. The ceremony was officiated by Mr Lu Lei, Deputy Governor of the PBoC. Representatives from system operators and participating institutions from the Mainland and Hong Kong also attended the ceremony.

Payment Connect refers to the linkage between the Mainland's Internet Banking Payment System (IBPS)1 and Hong Kong's Faster Payment System (FPS)2, which supports secure, efficient and convenient real-time cross-boundary payment for residents and institutions in both places. By simply inputting the recipient's mobile number or account number, residents in both places can make instant small-value cross-boundary remittances.

Mr Eddie Yue, Chief Executive of the HKMA, said, “Payment Connect is one of the key initiatives in strengthening cooperation between the Mainland and Hong Kong. The connection between the faster payment systems in both places enhances the efficiency of cross-boundary payments, supporting trade activities and personnel exchange. This development will further promote Hong Kong's position as an international financial centre and offshore Renminbi business hub. Payment Connect will cater to the daily needs of residents in both places for cross-boundary remittances and payments. It also signifies another milestone for the FPS in expanding cross-boundary payment.”

Six institutions each from the Mainland and Hong Kong (Annex) will participate in the Payment Connect upon its launch. They will roll out the service gradually and more institutions will join over time.

Mr Pan Gongsheng, Governor of the People’s Bank of China (centre); Mr Wang Linggui, Deputy Director of the Hong Kong and Macao Work Office of the Communist Party of China Central Committee and the Hong Kong and Macao Affairs Office of the State Council (second right); Mr Lu Lei, Deputy Governor of the People’s Bank of China (first right); Mr Eddie Yue, Chief Executive of the Hong Kong Monetary Authority (second left); and Mr Zhang Hui, President of the Bank of China (first left) attend the launch ceremony of Payment Connect today.

Mr Pan Gongsheng, Governor of the People’s Bank of China, delivers remarks at the launch ceremony.

Mr Wang Linggui, Deputy Director of the Hong Kong and Macao Work Office of the Communist Party of China Central Committee and the Hong Kong and Macao Affairs Office of the State Council, delivers remarks at the launch ceremony.

Mr Eddie Yue, Chief Executive of the Hong Kong Monetary Authority, delivers remarks at the launch ceremony.

Management of Hong Kong participating institutions attends the launch ceremony.

1 The Mainland China’s Internet Banking Payment System (IBPS) is the faster payment system in the Mainland, built by the China National Clearing Center under the guidance of the People’s Bank of China. IBPS enables user to make real-time cross-bank retail payment transactions through the mobile banking or online banking of his/her bank. By using the system, user can handle cross-bank account management, fund transfer, fund consolidation and other services without leaving home, and obtain instant transaction processing results.

2 The HKMA launched the Faster Payment System (FPS) in September 2018. This system connects banks and stored-value facility operators (SVFs), enabling the public to make real-time cross banks and cross SVFs fund transfers anytime and anywhere, by using the recipient's mobile number or email address.

Source: Press release from the Hong Kong Monetary Authority (please click here)

News in 2023

September 26, 2023

FPS x SME seminar and fifth anniversary of the FPS

The Hong Kong Monetary Authority (HKMA) organised the “FPS x SME” Seminar today (26 September). The seminar brought together over 130 representatives from small and medium-sized enterprises (SMEs), business chambers, banks, and Stored Value Facility (SVF) operators. Themed as “Exploring innovation, raising productivity and creating opportunities”, the seminar aimed to facilitate the exchange between the banking and SVF industries as well as SMEs. It aimed to explore the significance and growth opportunities of the Faster Payment System (FPS) in the SME payments.

In his welcome remarks, Mr Howard Lee, Deputy Chief Executive of the HKMA, said, “September 2023 marks the fifth anniversary of the launch of the FPS. We have witnessed the rapid growth of the FPS as a popular means of person-to-person payments. We look forward to the FPS achieving another major milestone by becoming even more widely adopted by corporates for payments. SMEs constitute a significant part of Hong Kong’s economy and play an essential role in establishing our position as an international financial centre. We aim to assist SMEs in leveraging the FPS to strengthen their competitiveness and support them in embracing the era of electronic payment (e-payment). This aligns with the HKMA's goal of promoting financial inclusion."

The panel discussion at the seminar discussed the challenges faced by SMEs when using FPS, and various FPS payment solutions provided by banks to facilitate the adoption of e-payment by SMEs. The seminar also featured an experience-sharing session where two SMEs explained how they had benefited from using the FPS in terms of increased operational efficiency, reduced administrative burden, and improved liquidity flow due to the instantaneous nature of FPS payments.

To mark the fifth anniversary of the launch of the FPS, the HKMA has joined hands with 21 banks and SVF operators (Annex 1) to introduce various promotional offers to corporate and individual customers. Nine of these banks and SVF operators have set up exhibition booths at the seminar today, explaining various FPS payment solutions and offering discounts on the spot to SME customers. Hong Kong Interbank Clearing Limited, the operator of the FPS, will exempt banks and SVF operators from settlement fees when processing real-time payments from corporates and merchants through the FPS in October. This aims to encourage banks and SVF operators to pass on the benefit to SMEs and merchants, further expanding the use of FPS among them, thereby achieving the goal of exploring innovation, raising productivity and creating opportunities.

During the seminar, Mr Howard Lee also mentioned that the collaborative effort between the HKMA and the Bank of Thailand has come to fruition. The bilateral linkage between FPS and PromptPay of Thailand is expected to be launched by this year. Hong Kong residents will then be able to make retail payments with the FPS in Thailand, while visitors from Thailand can use their equivalent faster payment system, PromptPay, to pay at merchants in Hong Kong. This arrangement aims to enhance the payment experience and provide an additional safe and fast payment option to customers in both places.

As of August 2023, the FPS recorded 12.81 million registrations, with an average annual growth of 36%. The use of the FPS has also continued to increase, registering an average annual rise of 71% and 41% respectively in its daily Hong Kong dollar real-time transaction volume and value in the past five years. In August, it processed an average of 1.25 million Hong Kong dollar real-time transactions per day, worth HK$ 9.9 billion.

Mr Howard Lee, Deputy Chief Executive of the Hong Kong Monetary Authority, delivers welcome remarks at the “FPS x SME” Seminar.

Mr Howard Lee, Deputy Chief Executive of the Hong Kong Monetary Authority (HKMA) (third from left, front row); Mr Colin Pou, Executive Director (Financial Infrastructure) of the HKMA (second from left, front row); and Ms Haster Tang, the Chief Executive Officer of the Hong Kong Interbank Clearing Limited (second from right, front row), together with representatives from banks and Stored Value Facility operators attend the seminar.

(From left) Mr Colin Pou, Executive Director (Financial Infrastructure) of the Hong Kong Monetary Authority moderates the panel discussion of the seminar. Mr Jaff Lau, Managing Director, Head of Strategy and Innovation, Business Banking of the Hongkong and Shanghai Banking Corporation Limited; Mr Neo Lau, Assistant General Manager, Commercial Banking Department of the Bank of China (Hong Kong) Limited; and Dr Thomas Su, Vice-Chairman, Small & Medium Enterprises Committee of the Hong Kong General Chamber of Commerce, participate in the discussion.

Representatives of two small and medium-sized enterprises, Ms Eva Fung, Co-founder of Cookieism (second from right), and Ms Ivy Tse, Co-Chief Executive Officer & Co-founder of FreightAmigo (first from right) share their experience of using Faster Payment System at the seminar. This session is hosted by Ms Haster Tang (first from left), the Chief Executive Officer of the Hong Kong Interbank Clearing Limited.

Mr Howard Lee, Deputy Chief Executive of the Hong Kong Monetary Authority (HKMA) (second from left); Mr Colin Pou, Executive Director (Financial Infrastructure) of the HKMA (first from left); and Ms Haster Tang, the Chief Executive Officer of the Hong Kong Interbank Clearing Limited (first from right), visit the exhibition booths set up by banks and Stored Value Facility operators at the seminar venue.

The seminar is attended by over 130 representatives from small and medium-sized enterprises, business chambers, banks and Stored Value Facility operators.

Source: Press release from the Hong Kong Monetary Authority (please click here)

News in 2022

The HKMA welcomes the launch of the Credit Reference Platform

The Hong Kong Monetary Authority (HKMA) welcomes the joint announcement of the Hong Kong Association of Banks, the Hong Kong Association of Restricted Licence Banks and Deposit-taking Companies and the Hong Kong S.A.R. Licensed Money Lenders Association Limited (collectively as the Industry Associations) today (28 November) on the launch of the Credit Reference Platform (CRP).

The HKMA has been working closely with the Industry Associations to introduce more than one consumer credit reference agency (CRA) in Hong Kong through the CRP, with a view to enhancing the service quality of consumer CRAs and reducing the operational risk of having only one commercially run service provider in the market, particularly the risk of single point of failure.

The HKMA fully supports the Multiple CRAs Model, which is an initiative in line with the “Fintech 2025” strategy in creating the next-generation data infrastructure and driving fintech development in Hong Kong. The HKMA would like to thank the Industry Associations, the Platform Operator, the Business Operator and other stakeholders for their enormous effort in developing the CRP and implementing the MCRAs Model.

After the launch of the CRP today, participating credit providers will start to load consumer credit data onto the CRP. The selected CRAs will then download the consumer credit data from the CRP in preparation for their provision of consumer credit reference services.

Please click here to read the press release from the Hong Kong Monetary Authority.

HKMA announces the official launch of Commercial Data Interchange

The Hong Kong Monetary Authority (HKMA) announced today (24 October) the official launch of Commercial Data Interchange (CDI), one of the key initiatives under its “Fintech 2025” strategy to create a next-generation data infrastructure and form an ecosystem for secure and seamless data exchange in Hong Kong.

As a consent-based financial data infrastructure, CDI aims to enhance data sharing by facilitating financial institutions to retrieve enterprises’ commercial data, in particular the data of small and medium-sized enterprises (SMEs), from both public and private data providers. With the launch of CDI, financial institutions could embrace more innovative applications to digitalise and streamline a wide range of financial processes, such as Know-Your-Customer (KYC), credit assessment, loan approval and risk management.

During the pilot launch, CDI has registered over HK$1.6 billion in approved SME loans. The proven usefulness of alternative data has attracted the participation of 23 banks (see the Annex) with material SME business and 10 data providers in CDI. In particular, six key data providers with substantial SME data have joined CDI at its official launch, and will start to provide consented access for banks in the CDI production environment. In this phase, the commercial data involved will include e-trade declaration, e-commerce, supply chain, payment and credit reference data.

To ensure that all CDI participants follow a common set of rules for proper, fair and secure exchange of commercial data, the HKMA also launched today the CDI Framework detailing the governance model and structure.

SMEs are encouraged to contact the participating banks to learn more about the new CDI-related financial services offered by the banks. More information is also available on the CDI website.

Going forward, the HKMA will continue to broaden the spectrum of data available via CDI, including data from government departments and analytics service providers, with a view to exploring new business use cases leveraging CDI.

Mr Howard Lee, Deputy Chief Executive of the HKMA, said, “With tremendous support from banks and data providers across various sectors, we are delighted to see CDI evolving from an idea to a pilot, and eventually a production-ready infrastructure throughout this two-year journey. Today’s official launch is a milestone signifying a new era of data sharing. We believe CDI will become a key enabler for multilateral data sharing among banks and data providers, catalysing financial innovations.”

Please click here to read the press release from the Hong Kong Monetary Authority.

News in 2021

Delivery versus Payment (DvP) Linkage with Bank of Japan

A new DvP link initiated by the HKMA and Bank of Japan for cross-currency securities transactions between the HKD payment system (CHATS) and the Bank of Japan Financial Network System for Japanese Government Bond (BOJ-NET JGB) Services was launched on 1 April 2021. This new link facilitates DvP settlement of the HKD sale and repurchase (repo) transactions using Japanese Government Bonds (JGB) as collateral and helps eliminate settlement risk by ensuring simultaneous delivery of HK dollars in Hong Kong and JGBs in Japan.

News in 2019

MPFA and HKICL Join Hands to Explore Payment Solution for the eMPF Platform

The MPFA and Hong Kong Interbank Clearing Limited (HKICL) today (10 December) entered into a collaboration agreement to explore appropriate electronic payment and clearing solutions for the future eMPF Platform.

Witnessed by Mr Cheng Yan-chee, MPFA Chief Corporate Affairs Officer and Executive Director, Mr Leo Chu, MPFA Chief Operating Officer and Executive Director, Mr Edmond Lau, Senior Executive Director of Hong Kong Monetary Authority (HKMA) and Mr Colin Pou, Executive Director (Financial Infrastructure) of HKMA, a Memorandum of Understanding (MoU) was signed by Ms Cynthia Hui, MPFA Executive Director (Members), and Ms Haster Tang, Chief Executive Officer of HKICL.

Mr Chu said, “One of the objectives of constructing the eMPF Platform is to enhance the MPF management efficiency and user experience of employers and scheme members. The Platform will not be complete without a seamless, secure and reliable electronic payment settlement system.”

Ms Hui said, “HKICL has developed major electronic payment systems such as the Faster Payment System (FPS), e-Cheque and the ePayment for MPF transfer between trustees. The extensive experience and knowledge of HKICL will facilitate the development of an efficient and suitable electronic payment solution for the eMPF Platform in anticipation of the voluminous MPF transactions in future.”

Mr Lau said, “The MoU signifies the mutual agreement in developing and promoting the financial infrastructure in Hong Kong for facilitating efficient processing of payments. I am glad that the FPS has seen extensive adoption, from person-to-person payment to business payment, shortly after launching for a year. Riding on the experience in developing this efficient and resilient electronic payment platform, I am sure it will facilitate the development of the eMPF Platform with diversified and innovative payment solutions. The HKMA will continue our efforts in exploring more use cases of the FPS and further promoting the e-payment ecosystem in Hong Kong.”

Ms Tang said, “Both the FPS and the eMPF Platform share the common objective of providing an efficient and reliable electronic payment service to the general public on a 24x7 basis. HKICL is confident that its successful experience of the FPS and other e-payment systems would be beneficial to the future eMPF Platform to be developed by MPFA in becoming a user-centric system with safe and efficient payment solution not only to meet the needs of stakeholders but also contribute to the further development of financial infrastructure in Hong Kong.”

Witnessed by Cheng Yan-chee, MPFA Chief Corporate Affairs Officer and Executive Director (2nd from left); Leo Chu, MPFA Chief Operating Officer and Executive Director (1st from left); Edmond Lau, Senior Executive Director of HKMA (2nd from right); and Colin Pou, Executive Director (Financial Infrastructure) of HKMA (1st from right), the MoU was signed by Cynthia Hui, MPFA Executive Director (Members) (3rd from left), and Haster Tang, Chief Executive Officer of HKICL (3rd from right) to explore appropriate electronic payment and clearing solutions for the future eMPF Platform.

News in 2018

FPS Activation Ceremony

Please click here to read the press release from the Hong Kong Monetary Authority.

Please click here to read the press release from news.gov.hk.

Faster Payment System (“FPS”)

Faster Payment System (FPS) is launched on 17 September 2018. The FPS is a payment financial infrastructure introduced by the Hong Kong Monetary Authority (HKMA) and operated by Hong Kong Interbank Clearing Limited (HKICL) to enable real-time fund transfer and payment services among banks and payment service providers (including stored value facilities (SVFs) licensed by and retail payment systems (RPS) designated by the HKMA). This real-time payment platform enables instant payments in Hong Kong, providing consumers and merchants a safe, efficient and widely accessible retail payment service on a 7x24 basis.

Please click here to read the press release from the Hong Kong Monetary Authority.

News in 2017

Extension of Central Clearing and Settlement System (CCASS) Real-time Delivery versus Payment (RDvP) Settlement Window

To facilitate the usage of CCASS RDvP service by the China Connect Markets, the Hong Kong Securities Clearing Company Limited (HKSCC) has extended the settlement window for CCASS RDvP Payments with effect from 20 November 2017. The new settlement window operates between 09:15 and 18:00 hours for HKD and USD currencies and between 09:15 and 19:45 hours for RMB currency, excluding Hong Kong general holidays on which CCASS will not be operated. The corresponding schedule for CCASS cutoff events has also been revised in view of this extension, with an additional CCASS interim cut-off at 15:30.

News in 2016

Enhancements for RMB FINInform Payment

As part of the continuous drive to promote efficiency and flexibility, user interface functions are provided for Global Users to enquire their transaction status, account debit limit and reference balance through the new iMBT channel over internet and/or existing eMBT channel via SWIFT network, with effect from 21 November 2016.

Sanction Screening of USD CHATS Payments by HSBC Sanction Screening System (“HSSS”)

USD CHATS has been enhanced to interface with the HSBC Sanction Screening System, replacing the Centralised Payment Filter, with effect from 1 August 2016 to provide corresponding payment sanction screening capabilities

Hong Kong-Guangdong Province (including Shenzhen) One-Way Joint Clearing for HKD, USD and RMB e-Cheque and Hong Kong-Guangdong Province One-Way Joint Clearing for USD Paper Cheque

A new one-way Hong Kong-Guangdong and Hong Kong-Shenzhen cross-border e-Cheque clearing service of HKD, USD and RMB e-Cheques is launched on 20 July 2016. The cross-border e-Cheque links are implemented to facilitate efficient processing of e-Cheque clearing between Guangdong Province (including Shenzhen) and Hong Kong. Through the joint clearing arrangement, payees in Guangdong Province (including Shenzhen) can present e-Cheques drawn on banks in Hong Kong to banks within Guangdong Province (including Shenzhen) for further clearing and settlement in Hong Kong by HKICL.

While the Hong Kong-Shenzhen joint clearing for USD paper cheque was already implemented in 2004, we have taken this opportunity to implement the Hong Kong-Guangdong Province one-way joint clearing for USD paper cheque on the same date (i.e. 20 July 2016).

Same Day CCASS Night Settlement (“SCASSN”)

A new Renminbi same day settlement run in late evening for CCASS items is introduced on 18 April 2016. It serves to mitigate the overnight counterparty risk that may arise between investors and brokers in connection with the settlement instructions relating to securities listed in Mainland China. The Central Clearing and Settlement System generates the relevant items and submits to HKICL by Hong Kong Securities Clearing Company Limited for settlement on the same day.

Interbank Intraday Liquidity Facility

A new Interbank Intraday Liquidity Facility function is introduced in HKD CHATS, USD CHATS, RMB CHATS and Euro CHATS on 18 January 2016. It serves to enhance efficiency of the liquidity provision mechanism between Liquidity Provider(s) and its registered Liquidity Consumer(s) in respective CHATS.

News in 2015

Electronic Cheque (“e-Cheque”) Service

The e-Cheque service, launched on 7 December 2015, is an integrated presentment, clearing and settlement platform to facilitate (i) payee to present e-Cheques (including e-Cashier’s Orders) to its bank through presentment channels such as internet banking system provided by the payee’s bank or the e-Cheque Drop Box Service provided by HKICL; and (ii) clearing and settlement of e-Cheque payments. Under the e-Cheque service, both the payer and payee can execute timely payments enabled by electronic means.

RMB FINInform Payments

A new payment function is introduced in RMB CHATS on 14 September 2015 allowing Direct Participants (DPs) to act as settlement banks for registered indirect users, namely Global Users (GUs), where the GUs can exchange RMB payment messages via SWIFT’s FINInform Y-copy service for the account of their respective DPs, thus enhancing straight-through-processing, efficiency and transparency of RMB RTGS payment processing.

Extension of Renminbi ("RMB") CHATS and Central Moneymarkets Unit Processor (“CMUP”) Operating Window

With further rising demand for RMB clearing service around the world and to further strengthen Hong Kong’s offshore RMB market, the Hong Kong Monetary Authority and RMB Clearing Bank have approved an extension of the RMB CHATS operating hours from the current window between 08:30 hours and 23:30 hours (the bank cut-off time), to between 08:30 hours and 05:00 hours (the bank cut-off time) of the next calendar day on all weekdays except 1 January starting from Monday, 20 July 2015. RMB CHATS will also open between 08:30 hours and 18:30 hours (the bank cut-off time) on special Saturdays and Sundays which are designated as working days in Mainland China. To facilitate RMB clearing members to better manage their RMB liquidity, the daily closing time of CMUP has also been extended from 23:30 hours to 05:00 hours of the next calendar day to align with the operation schedule of RMB CHATS on all weekdays.

News in 2014

Monthly Intraday Liquidity Monitoring Report

To facilitate Member’s management of intraday liquidity, a new Monthly Intraday Liquidity Monitoring Report was introduced to CHATS of all four clearing currencies on 17 November 2014. This new report facilitates Members to monitor their intraday liquidity usage and positions arising from CHATS activities.

Payment-versus-Payment Settlement for US Dollar ("USD") and Thai Baht ("THB")

A new cross-border payment-versus-payment (PvP) link between the USD CHATS and the BAHTNET system (Bank of Thailand’s Thai Baht RTGS system) for settlement of USD/THB foreign exchange transactions was launched on 28 July 2014. This new link facilitates PvP settlement of USD/THB foreign exchange transactions by eliminating settlement risk for the banking institutions in Hong Kong and Thailand.

Mandatory Provident Fund (MPF) Money Settlement Service

To enhance the efficiency of MPF funds settlement among trustees arising from investor portfolio transfers, the HKMA and Mandatory Provident Fund Schemes Authority have jointly introduced money settlement for MPF funds transfer (“MPF Money Settlement Service”) under the Central Moneymarkets Unit (“CMU”) of the HKMA with effect from 19 May 2014.

All MPF trustees in Hong Kong will participate as CMU members and engage settlement banks who are Members of the Clearing House to carry out money settlement on their behalf in the new MPF bulk settlement run in the HKD clearing system.

News in 2013

Electronic Bill Presentment and Payment (EBPP)

EBPP, a platform established by the joint effort of Hong Kong’s banking industry, provides a single consolidated platform that enables the general public to receive and pay bills, or to make donations and receive donation receipts via their internet banking systems. Effective from 18 November 2013, participating banks can exchange merchant, enrolment, bill presentment and donation receipt information through this centralised service. In addition, bill related payments and donations in HKD, USD or RMB can be settled via the corresponding clearing and settlement service.

Delivery versus Payment Link with Euroclear Bank

To facilitate cross-border collateralised lending and borrowing, the delivery versus payment (DvP) facilities of CHATS is extended to securities transactions settled in Euroclear Bank effective 17 June 2013. A linkage between the CHATS of HKICL and global tripartite repo system of Euroclear Bank is established for supporting DvP settlement of the transfer of collateralised securities in Euroclear Bank and the transfer of funds in CHATS simultaneously.

Alphanumeric Clearing Code

Effective 18 March 2013, three-digit alphanumeric clearing codes will be introduced for overseas direct participants (“DPs”) of USD Clearing, Euro Clearing and RMB Clearing, so as to save the usage of the current three-digit numeric clearing codes for local clearing member. Alphanumeric clearing codes will be assigned to overseas DPs that do not participate in bulk clearing and CCASS money settlement services (including paper cheque clearing, CCASS and other electronic clearing service, and/or CCASS real-time DvP service).

HKICL Network (ICLNet)

ICLNet, a secure, open, scalable, and high performance restricted-access private IP-based network for connecting the respective computer systems of the financial institutions and other licensed financial entities in Hong Kong to exchange electronic data efficiently and in a secure manner, commenced operations on 18 March 2013.

News in 2012

Dual Sites Operations

HKICL relocated its production clearing centre, data centre and main office from Hong Kong Island to Kowloon on 17 December 2012. The Hong Kong Island offices were converted into the Company’s backup clearing and data centre at the same time. With a view to providing better clearing service and bringing convenience to Members after HKICL’s relocation, clearing counter services are provided at both Hong Kong Island and Kowloon centres (Dual Sites Operations) to facilitate Members’ outward submission and inward collection of clearing/returned items.

Cross-border Autodebit Service between Guangdong (“GD”) and Hong Kong (“HK”) using China UnionPay HKD/RMB Debit Cards and Direct Debit RMB Account

Following the launch of the cross-border autodebit service between Shenzhen and HK that enables customers in Hong Kong to make autodebit payments to merchants such as utility companies, telephone operators, estate management companies, etc. in Shenzhen, China, this service has been extended to cover Guangdong province starting from 16 July 2012. This service provides greater convenience to customers in Hong Kong, who can make payments by debiting their China UnionPay HKD/RMB debit cards, or RMB bank accounts in Hong Kong to eligible merchants in the Guangdong Province.

Extension of Renminbi ("RMB") CHATS and Central Moneymarkets Unit Processor ("CMUP") Operating Window

To strengthen Hong Kong’s capability in settling overseas RMB payments, the Hong Kong Monetary Authority and RMB Clearing Bank have approved an extension of the RMB CHATS operating hours from the current window between 08:30 hours and 18:30 hours (the bank cut-off time), to between 08:30 hours and 23:30 hours (the bank cut-off time) on all weekdays except 1 January effective Monday, 25 June 2012. To facilitate RMB clearing members to better manage their RMB liquidity, the daily closing time of CMUP has also been extended from 18:30 hours to 23:30 hours to align with the operation schedule of RMB CHATS.

News in 2011

RMB EPS and RMB Same Day Settlement EPS

As a continuous expansion of the RMB business in Hong Kong, we have launched the new RMB EPS and RMB Same Day Settlement services on 21 November 2011. These services facilitate the clearing and settlement of retail payment transactions of the participating merchants of EPSCO in RMB currency.

CCASS T+2 Money Settlement Service ("Service")

The Service was launched on 25 July 2011. Under the new arrangement, the overnight credit risk arising from the settlement gap between stock and money is minimized since the securities trades settled by the Central Clearing and Settlement System operated by Hong Kong Securities Clearing Company Limited and the interbank money settlement for these trades via HKICL would be done on the same day.

Renminbi ("RMB") Autopay and RMB Special CCASS Items

To support the expansion of RMB business in Hong Kong, we have launched a new RMB Autodebit and Autocredit service on 21 March 2011. Furthermore, to facilitate the timely clearing and settlement of RMB Initial Public Offering refund, a new bulk clearing service for RMB Special CCASS items was introduced also on the said date.

News in 2010

Regional CHATS Payment Service (“RCPS”)

To sustain Hong Kong’s status as a regional hub and to cope with the expansion of local Renminbi (“RMB”) business, the RCPS has been enhanced to include RMB in addition to the original 3 currencies, i.e. HKD, USD and Euro. This additional service is available since 20 December 2010. RCPS service providers who wish to provide RMB RCPS can subscribe this enhanced service with HKICL.

Same Day Settlement JETCO Items

This new service launched on 20 September 2010 allows the members of Joint Electronic Teller Services Limited (“JETCO”) an option to enjoy earlier funds availability as the interbank payments initiated by JETCO are settled within the same day of submission. The existing settlement on the working day after submission remains unchanged.

Same Day Settlement EPS Items

This new service launched on 20 September 2010 allows the participating merchants of Easy Payment System (“EPS”) an option to enjoy earlier funds availability as the settlement of the EPS items submitted to HKICL by Easy Payment System Company (Hong Kong) Limited is done within the same day of submission. The existing settlement on the working day after submission remains unchanged.

Cross-border Autodebit Service Using China UnionPay HKD Debit Cards

In view of the frequent economic interaction between Hong Kong and Shenzhen, we have launched a Cross-border Autodebit Service jointly with China UnionPay (“CUP”) and Shenzhen Financial Electronic Settlement Centre on 27 September 2010. This service facilitates payment made by debtors in Hong Kong to merchants in Shenzhen using CUP HKD Debit Card.

Browser-based RTGS front-end applications on SWIFTNet and Internet

The front-end terminal applications of the RTGS systems were successfully migrated from the text-based MBT/400 and CMT/400 to browser-based applications on 12 July 2010. After the migration, eMBT via SWIFTNet is the front-end terminal application of CHATS of all clearing currencies, while eCMT via SWIFTNet and iCMT via the Internet are the front-end terminal applications of the HKMA's CMU. The new eMBT, eCMT and iCMT are user friendly applications that improve the users’ operations in addition to the enhanced system functionalities.

Payment-versus-Payment Settlement for US Dollar ("USD") and Indonesian Rupiah ("IDR")

A new payment system linkage between the USD CHATS and the BI-RTGS System (Bank Indonesia's RTGS system) for payment-versus-payment (“PvP”) settlement of USD/IDR foreign exchange transactions was launched on 25 January 2010. This new payment systems linkage facilitates PvP settlement of USD/IDR foreign exchange transactions as a measure to eliminate settlement risk for the banking institutions in Hong Kong and Indonesia.

News in 2009

The establishment of cross-border links with the clearing and settlement systems of other Asian countries will help developing Hong Kong into a payment and settlement hub for the region. Following the successful linkage of USD CHATS with RENTAS (a real time electronic transfer of funds and securities system) in Malaysia to facilitate the real time payment versus payment transactions of USD/Malaysian Ringgit, and the settlement in Hong Kong of the cash leg of the real time delivery versus payment transactions of USD bonds traded in Malaysia, a cross border link for fund transfers between Hong Kong’s RTGS systems and the Mainland’s foreign currency RTGS systems was launched on 16 March 2009. This cross border link facilitates 2-way real-time USD, HKD and Euro funds transfers between banks in Hong Kong and banks participating in the RTGS systems of the respective currencies in the Mainland. A list of the banks in Mainland that participate in the cross border link can be found on HKICL website.

Effective 25 May 2009, the RTGS systems of all clearing currencies are able to support payment transactions transmitted in SWIFT message format.

News in 2008

Effective 23 June 2008, in addition to HKD cheques, USD cheques drawn on banks in Macau and presented by banks in Hong Kong can be settled on the following working day.

The RTGS operating hours were extended by one hour from 17:30 hours to 18:30 hours, Mondays to Fridays except General Holidays, effective 3 November 2008 in order to allow banks in Hong Kong that have business with the Mainland and western Asian countries more time to process their remittance payments which in turn could enhance their services and help developing Hong Kong as a regional payment HUB to serve the neighbour countries in the region.

A new clearing service to enhance the refund process of the electronic initial public offering (“eIPO”) of the Central Clearing and Settlement System (“CCASS”) was launched on 15 December 2008. Under this new service, the inter-bank settlement of the eIPO refund monies is performed on the refund day so that the CCASS participants can receive the refund monies in good funds on the same day instead of previously on the working day following the refund day. .

News in 2007

The Regional CHATS Payment Services was launched in July 2007 which linked all participants of the existing HKD, USD and Euro RTGS systems in Hong Kong in order to build an extensive correspondent network to facilitate the cross-border payments through the RTGS systems in Hong Kong during Asian business hours.

To support the clearing and settlement of the RMB-denominated transactions in Hong Kong, a full-fledged Renminbi RTGS system, and the RMB local cheque clearing were introduced on 18 June 2007.

The one-way clearing for HKD cheques drawn on banks in Hong Kong and presented by banks in Macau was introduced in August 2007 to reduce the time taken for Macau residents to receive funds.

The linkage between Hong Kong’s USD RTGS Systems and Malaysia’s Rentas Scriptless Securities Trading System for delivery-versus-payment settlement of USD bonds in Malaysia was introduced on 12 November 2007. This linkage eliminates settlement risk of USD bonds issued and traded in Malaysia by ensuring simultaneous delivery of US dollars in Hong Kong and USD bonds in Malaysia.

The opening of the RTGS settlement window was advanced by 30 minutes from 09:00 hours to 08:30 hours with effect from 3 December 2007 in order to allow banks more time for the settlement of CCASS related payments given the booming stock market, which in turn helps banks to better manage their liquidity for the settlement of CCASS items.

News in 2006

Payment versus Payment (PvP) Settlement for USD and Malaysian Ringgit (MYR)

The Hong Kong Monetary Authority and Bank Negara Malaysia (BNM), the Central Bank of Malaysia has agreed to establish a link between the Ringgit real-time gross settlement system in Malaysia (the RENTAS system) and the USD real-time gross settlement system in Hong Kong (USD RTGS system). This payment link enables the reduction of foreign exchange settlement risk through the implementation of a PvP mechanism during the Malaysia and Hong Kong business hours, and helps to increase the efficiency and safety of payment systems in Malaysia and in the region, in particular to manage FX settlement risk exposure for the FX transactions involving the US dollar and MYR.

This new system was launched on 13 November 2006.

Renminbi Settlement System

HKICL has been engaged by Bank of China (Hong Kong) Limited, the Clearing Bank ("CB") for RMB business in Hong Kong, to develop a Renminbi Settlement System ("RSS") that provides participants of this system with RMB cheque clearing service, and real-time RMB payment services including RMB position-squaring, remittance processing, and RMB bank card payment.

Licensed banks in Hong Kong, as well as their credit card subsidiaries can join the RSS with the permission from the CB and the HKMA, and each participant has to maintain a settlement account with the CB. The RSS is launched on 6 March 2006.