Benefit of FPS

| Simple Instead of inputting the account number, you only have to enter mobile number or email address of the recipient. |

| Assurance When you are making payment using recipient’s mobile number or email address, you will see the automatic display of the masked name linked to that mobile number or email address before you confirm the payment. This gives you confidence your money is going to the right place. |

| Convenience Payment can be made 24 hours a day, 7 days a week, anytime, anywhere. |

| Fast Funds reach recipients almost immediately*.

*The service is provided by banks and SVFs to their users, and the actual transaction time may vary. |

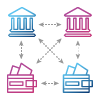

| Full Connectivity You can make payments to different banks and SVFs. |

How do I send money via FPS?

Process may vary depending on your service provider.

Notes:

If the payee has not registered the mobile number or the email address with the FPS, the payer may enter the account number of payee to send payments.

The payee will receive funds immediately if his/her bank/SVF supports FPS real time payments, or otherwise the payee will receive the funds by the next day the latest.

How do I receive money via FPS?

Check if your bank/SVF supports real-time payments via the FPS

Complete a one-off registration with your bank/SVF to link up the mobile number or the email address with an account. Learn more

Simply provide your mobile phone number or email address to the payer to send funds to you

Provide your full name and account number to the payer if you have yet to register your mobile number or email address

Registration

Registration of mobile number/email address

Link up your mobile number and/or email address to an account for receiving funds by registering with a bank or SVF (for example, online/mobile banking and e-wallet).

You may link up your mobile number/email address to one or more bank/SVF accounts.

- Within each bank/SVF, select only one account to receive payments

- If you register with more than one bank/SVF, you must decide which one is the default account to receive fund.

How do I register?

The registration process may vary depending on your bank/SVF.

- Log in to the online/mobile banking or e-wallet of your bank(s)/SVF(s);

- Select the account and enter the mobile number and/or email address to link up the account;

- Check box if the account is to be set as default receiving account;

- Verify that you are the genuine holder of the mobile number/email address through SMS One-Time-Password or other means of verification; and

- Receive notification on result of registration.

No personal data of yours will be collected by visiting the Faster Payment System webpage. If you have any queries related to personal data privacy and privacy policy for FPS services provided by banks or Stored Value Facilities, please contact your respective banks or Stored Value Facilities.

Registration of the HKID Number

From 6 December 2020 onwards, you can also link up your HKID number to a bank account for receiving funds by registering through the online/mobile banking of your bank. Given the HKID number is a piece of sensitive personal information, this new function is not intended for making person-to-person payments. It will only be used by institutions which already possess your HKID number for making payments. You may register to use this account proxy depending on your needs.

How do I register?

The registration process may vary depending on your bank.

- Log in to the online/mobile banking of your bank and choose to register your HKID number as an FPS proxy on the “FPS Registration” page;

- Enter your full or partial HKID number which may be required by your bank;

- Choose a receiving account;

- Receive notification on result of registration.

Unlike mobile number and email address which can be linked up to more than one bank/SVF account, you can only link up your HKID number to one sole-name bank account (joint bank account is not allowed). If you wish to change your linked bank account in the future, you need to register again. The new registration will supersede the existing record.

Direct Debit

Direct Debit is an instruction to withdraw funds from an account directly. Proper authorisation must be established prior to the execution of a direct debit payment.

It helps make the settlement of bills easier and simpler by automating regular transfer of funds from customer account to merchant account, such as utility bills.

Also, it can be used to link up customer account for online shopping or e-wallet top-up transaction by real-time direct debit.

Direct debit mandates can be created in several ways; paper-based forms which require a signature, using online application form and through other interactive service.

QR code payment

How to receive payments using a QR code:

- Check if your bank/SVF supports FPS QR code payment

- Generate an FPS QR code from the app

- Provide it to payer for scanning

- Payer to scan

- Details shown automatically to payer for checking

- Payer input the amount and pay

Consumers can scan the FPS QR code provided by the payee, which may be displayed on a mobile device, a bill or a checkout screen.

Consumers should always check the payment details shown, including the name of the payee and the amount to be paid, before confirming the payment.