Payment Connect

Payment Connect refers to the linkage of the Mainland’s Internet Banking Payment System (IBPS) and Hong Kong’s Faster Payment System (FPS)

With the joint support of the People’s Bank of China (PBoC) and the Hong Kong Monetary Authority (HKMA), the linkage of the faster payment systems in the Mainland and Hong Kong has been implemented to support the provision of real-time cross-boundary payment services for residents and institutions in both places

The participating institutions from the two places launched the service to the public on 22 June, 2025

Benefits

- Receiving institution not confined to those within the same group, but across different institutions

- Recipients not confined to same-name or immediate family members

- A wide range of current account payment, including P2P payments and those related to daily living

- Anytime, anywhere, and settled instantly

- Mobile number and other account proxies can be used

- Low transaction costs

- Support RMB or HKD remittance (pay directly from RMB accounts or real-time exchange of HKD for RMB remittances) and receipt in funds in RMB for northbound payments

- Support RMB remittance and receipt in funds in either HKD or RMB for southbound payments

Key Features

The following service scope and use cases are provided by the PBOC and the HKMA. Please refer to HKMA’s website https://www.hkma.gov.hk/eng/smart-consumers/payment-connect for details.

P2P Remittance

| Eligible Payer | Hong Kong Identity Card Holder | Mainland Identity Card Holder |

| Limit | Daily limit of HKD 10,000 per person, and annual limit of HKD 200,000 per person (for each participating institution) The limit is separate from the existing daily remittance limit of RMB 80,000 that applies to the same-name transfers Please refer to HKMA’s website https://www.hkma.gov.hk/eng/smart-consumers/payment-connect for details. | Follow the existing facilitative foreign exchange arrangement available for Mainland residents, subject to an annual quota equivalent to USD 50,000 per person Please refer to HKMA’s website https://www.hkma.gov.hk/eng/smart-consumers/payment-connect for details. |

| Documentary Proof Required | Nil (The payee is restricted to personal account holders only) | Nil |

| Service Hours | 24x7 | 16x7 Note: The current service hours are from 7:00 AM to 11:00 PM daily, which may vary subject to individual Mainland participating institutions. |

| Types of Account Proxy Supported | 1. Mobile number 2. Bank account number | 1. Mobile number, email address and FPS ID 2. Bank account number |

Remittance related to activities of daily living in the two places

| Use Cases |

|

Note:

Service are provided by participating institutions, and the functions and scope of coverage offered by each institution may vary. Additionally, some features may be introduced gradually over time. For example, Hong Kong payers can input a Mainland mobile number to transfer funds to the Mainland residents' accounts that have enabled cross-boundary fund receipt via mobile number. As for Mainland accounts held by Hong Kong residents, Mainland participating institutions are optimizing the relevant functions. Depending on the development progress, Mainland participating institutions will gradually roll out this feature. Please consult participating institutions for further details.

How to use

How to Transfer Funds to a Payee in the Mainland

Select mobile number as the payment method

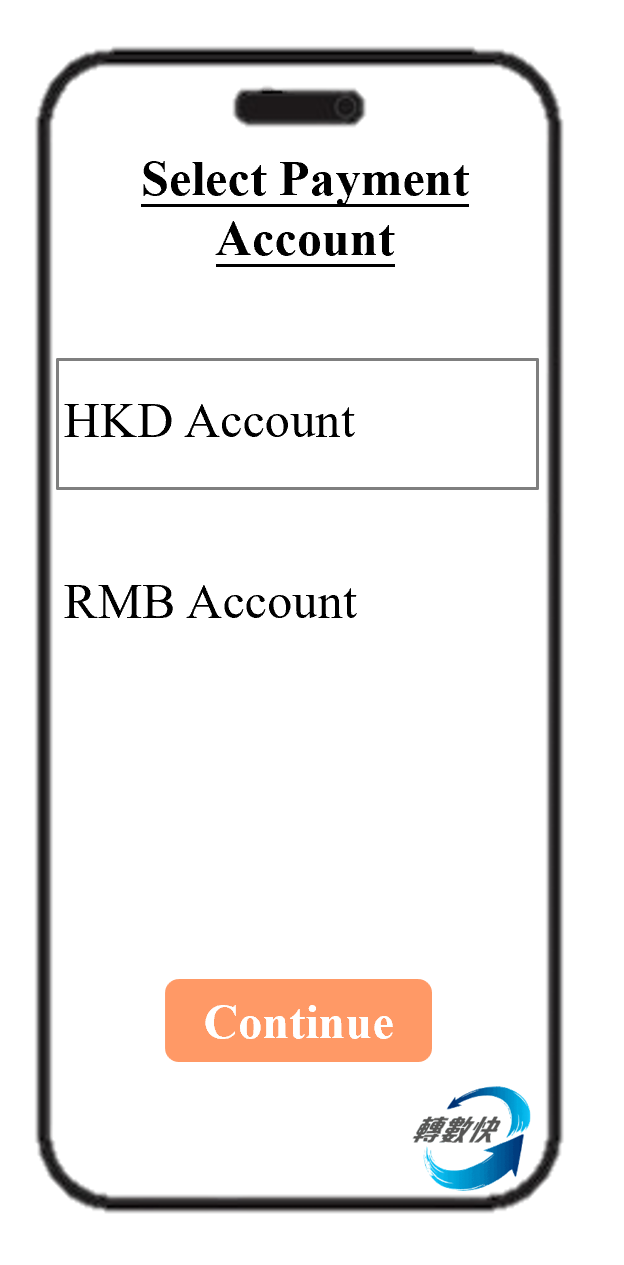

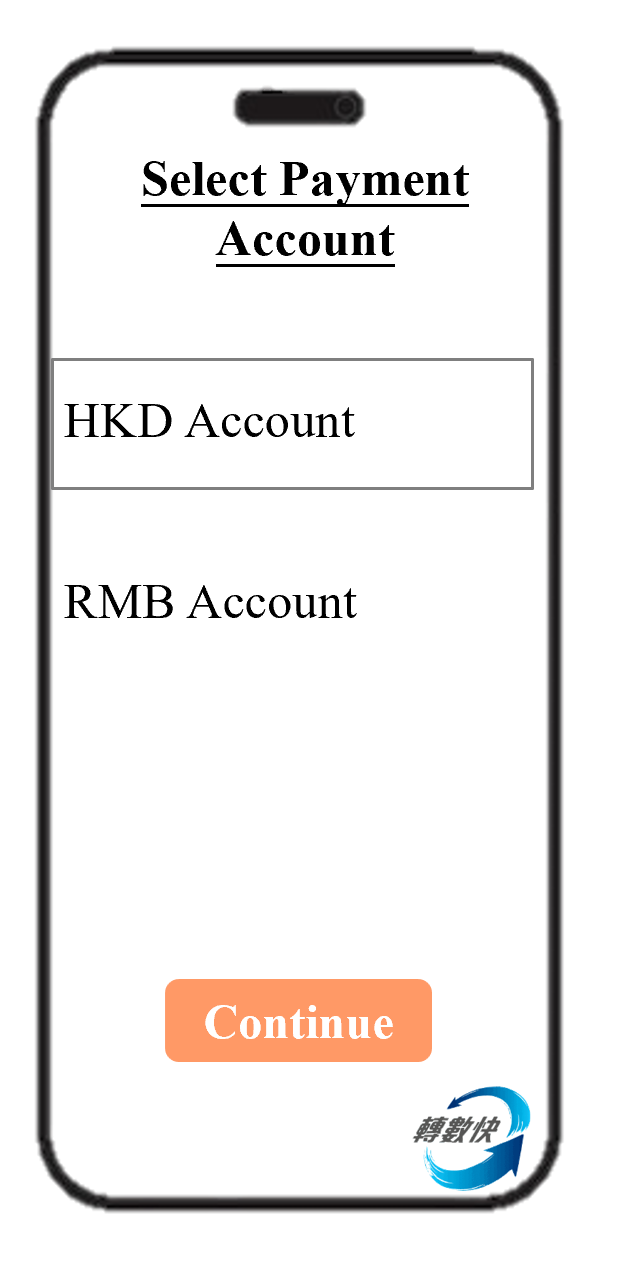

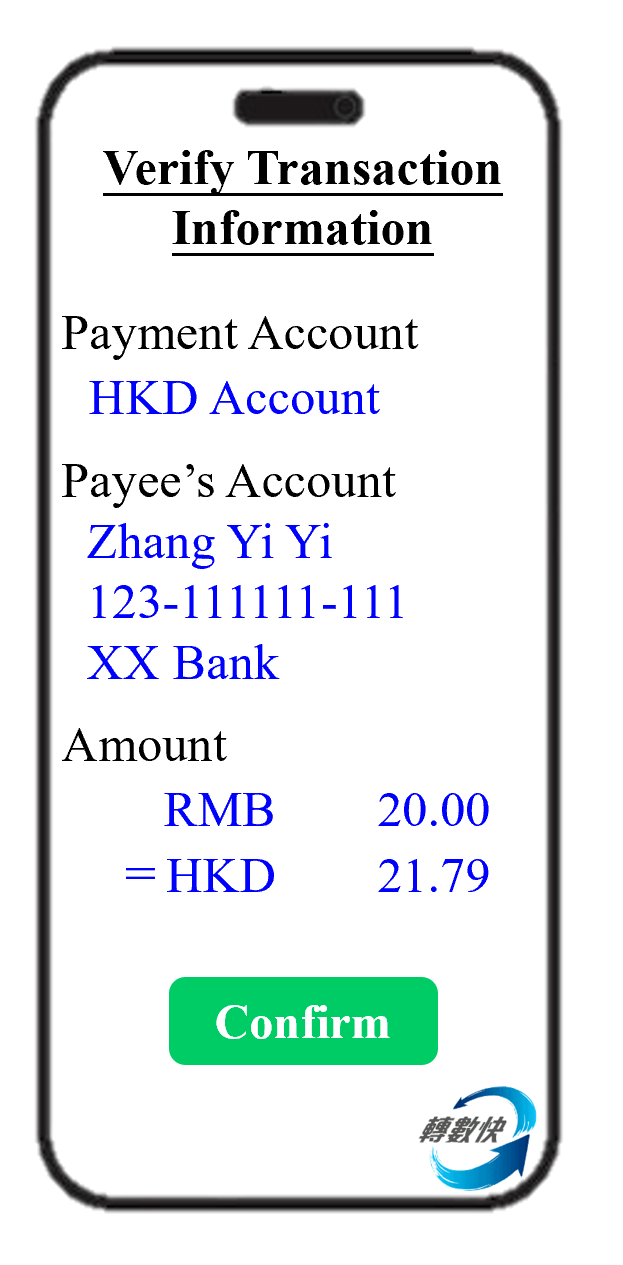

| Step 1. Select payment account (HKD/RMB account) |

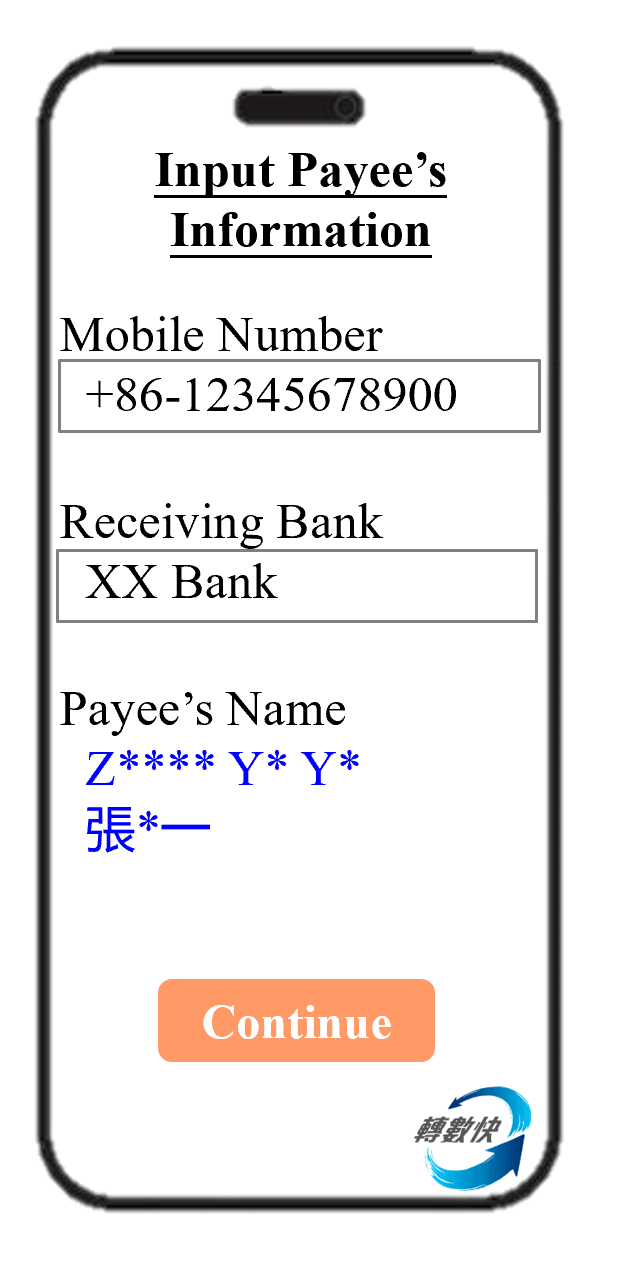

| Step 2. Enter the payee’s mobile number and bank name, and verify if the partially masked payee’s name displayed on the screen is correct |

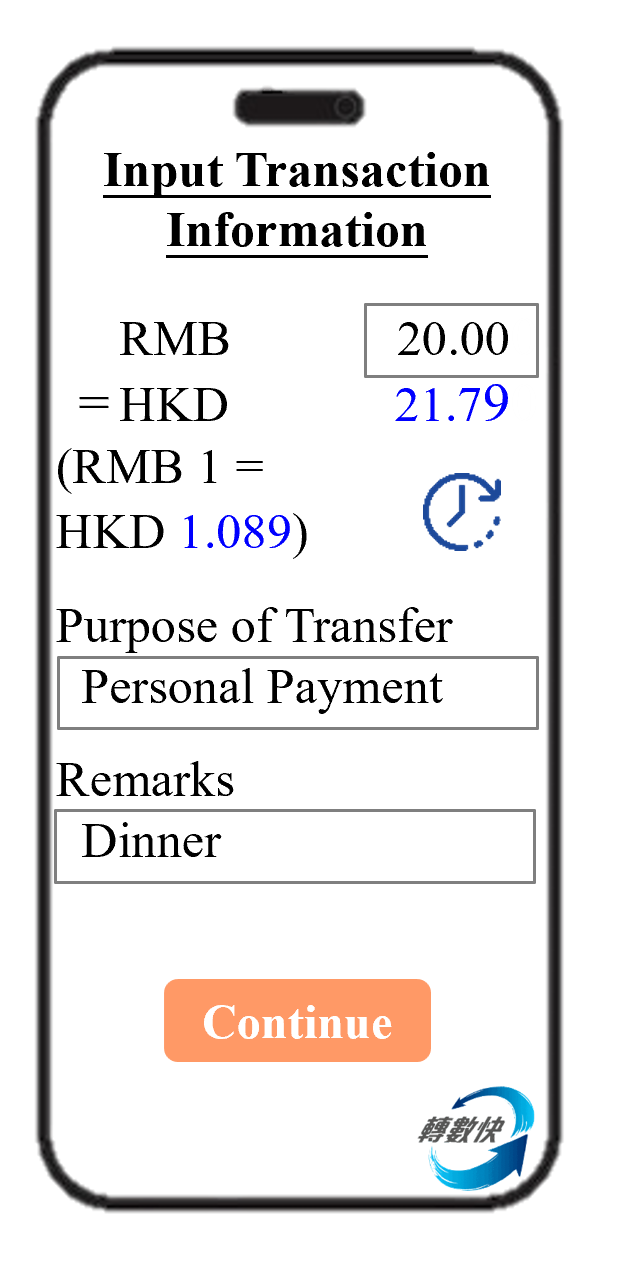

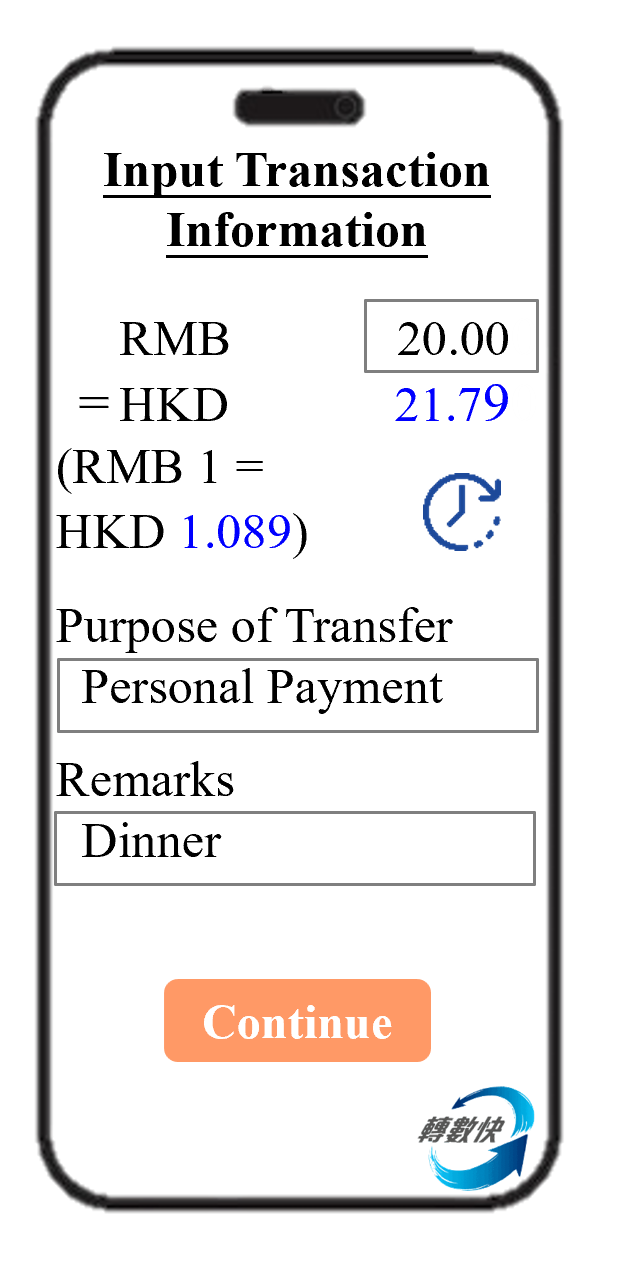

| Step 3. Enter the payment amount, purpose of transfer and remarks (if applicable), and confirm the applicable exchange rate when selecting the HKD account as payment account |

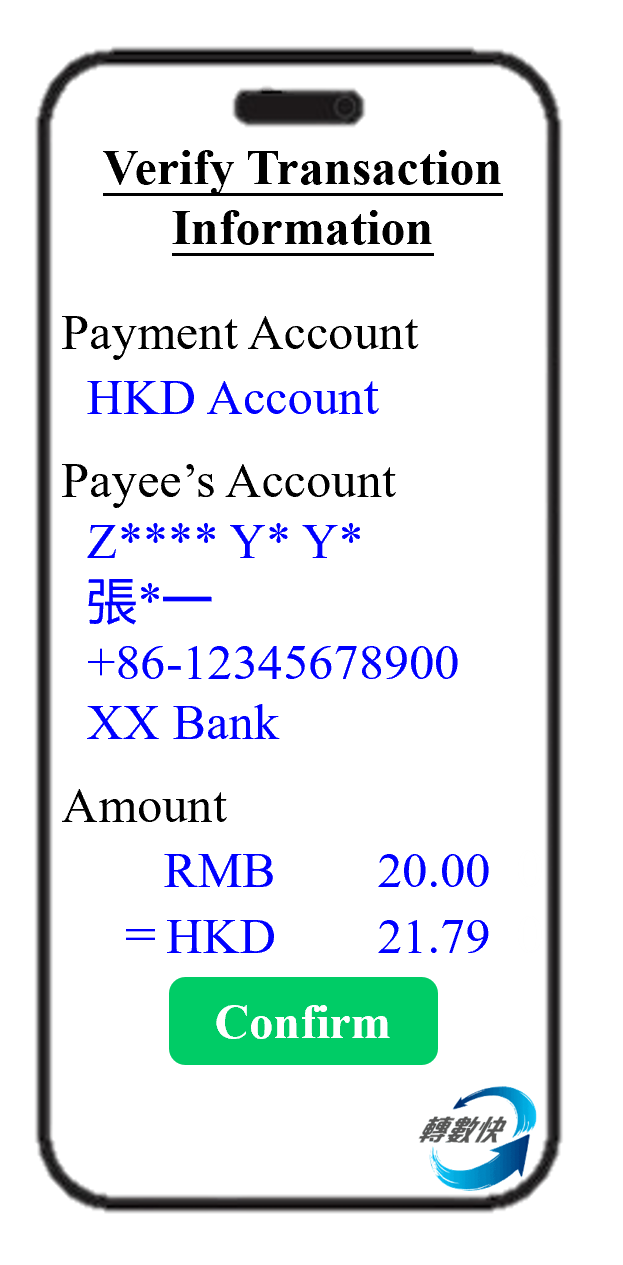

| Step 4. Verify the transaction details, including the payment account, payee’s name, mobile number, payee’s bank name, RMB amount and equivalent to HKD (if applicable). Confirm the transaction only after ensuring accuracy of all information |

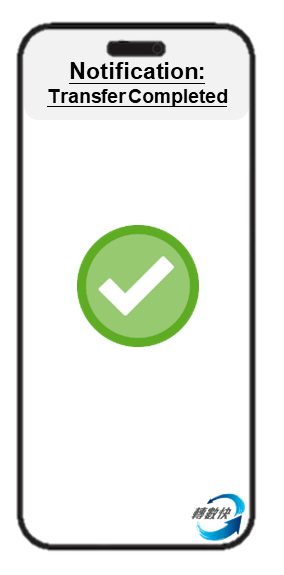

| Step 5. The payer receives a payment notification |

Select bank account number as the payment method

| Step 1. Select payment account (HKD/RMB account) |

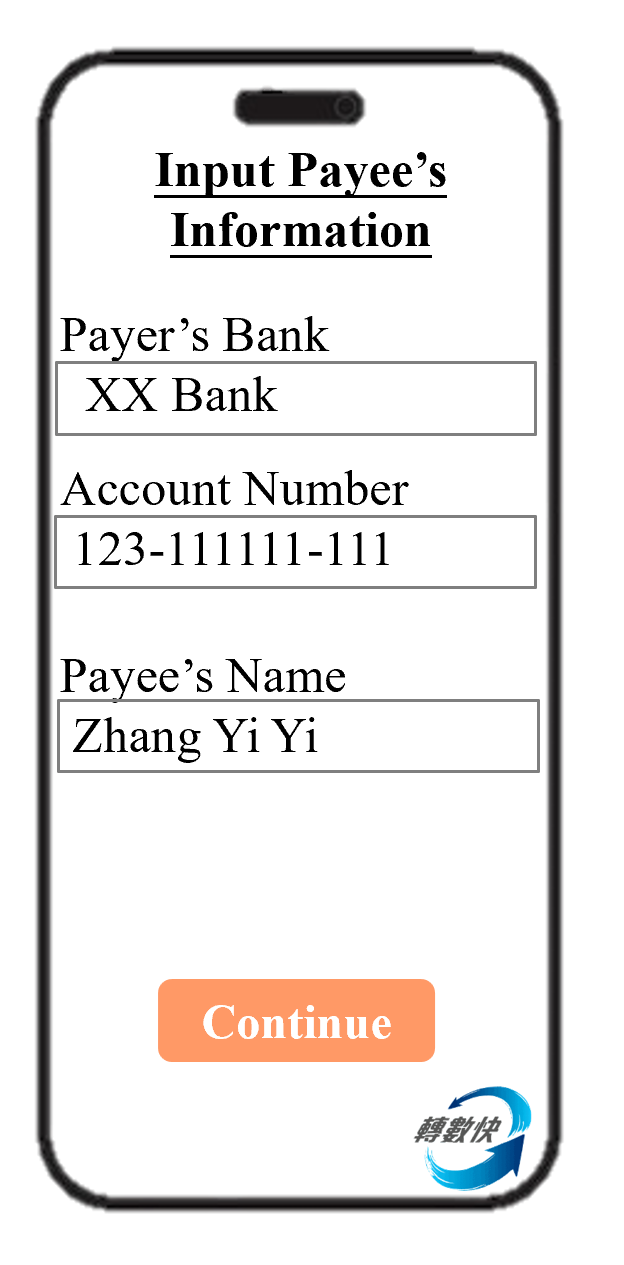

| Step 2. Enter the payee’s bank name, bank account number and name in English |

| Step 3. Enter the payment amount, purpose of transfer and remarks (if applicable), confirm the applicable exchange rate when selecting the HKD account for the transfer |

| Step 4. Verify the transaction details, including the payment account, payee’s name, mobile number, payee’s bank, RMB amount and equivalent to HKD (if applicable), confirm the transaction only after ensuring accuracy of all information |

| Step 5. The payer receives a payment notification |

Note:

1. Receiving bank options include Mainland participating institutions that support Payment Connect

2. Purpose of transfer options include personal payments, tuition fees, medical expenses and utility bills

3. Process may vary depending on your service provider.

4. For more detailed information, please refer to the section of “Smart Tips”.

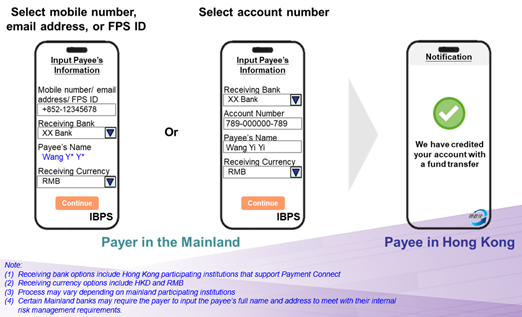

How to Receive Funds from a Payer in the Mainland

1. | If the account for receiving funds is already linked to a FPS proxy, then no further registration for FPS is required | |

2. | If bank account number is selected as the payment method, the payer should select the bank name | |

3. | If mobile number is selected as the payment method, the payer should select the bank name and enter the payee’s English name | |

4. | It is recommended that the payee communicates with the Mainland payer in advance to indicate the chosen currency for receipt, either HKD or RMB, and provides a bank account number or a linked FPS proxy that can receive chosen currency | |

5. | Certain Mainland banks may require the payer to input the payee’s full name and address to meet with their internal risk management requirements | |

6. | The funds will be credited immediately and a notification will be sent to the payer once the payment is completed |

Smart Tips

- Ensure the mobile banking app be updated to the latest version

- Ensure that the Mainland payee has enabled cross-boundary fund receipt via mobile number, i.e., his/her bank account be linked a mobile number and the payee’s information be updated as required

- If bank account number is selected as the Northbound payment method, the mainland payee can verify whether their personal information includes an English (or Pinyin) name in record through mobile banking or customer service. Please consult the Mainland participating institutions for further details

- Communicate and confirm the payment detail with the Mainland payee in advance, and verify the transaction information before making the payment

- Ensure the receiving account be able to receive funds in the chosen currency before providing the account information to the Mainland payer

Participating Institutions

As of 29 January, 2026:

Hong Kong

| Airstar Bank Limited | 1. Mobile banking app | +852 3718 1818 | |

| Ant Bank (Hong Kong) Limited | 1. Mobile banking app | +852 2325 0303 | |

| Bank of China (Hong Kong) Limited | 1. Mobile banking app 2. Internet banking | +852 3988 2388 | |

| Bank of Communications (Hong Kong) Limited | 1. Mobile banking app 2. Internet banking | +852 2239 5559 | |

| Bank of East Asia, Limited (the) | 1. Mobile banking app | +852 2211 1321 | |

| China CITIC Bank International Limited | 1. Mobile banking app | +852 2287 6767 | |

| China Construction Bank (Asia) Corporation Limited | 1. Mobile banking app 2. Internet banking | 1. +852 2779 5533 2. +86 40019 95533 (Mainland) | |

| China Guangfa Bank Co., Ltd Hong Kong Branch | 1. Mobile banking app | +852 3850 9800 | |

| China Merchants Bank Co., Ltd. | 1. Mobile banking app | 1. +852 31195555 2. +86 755 95555 (Mainland) | |

| China Minsheng Banking Corp., Ltd. Hong Kong Branch | 1. Mobile banking app 2. Internet banking | 1. +852 2519 5568 2. +86 95568 (Mainland) | |

| Chong Hing Bank Limited | 1. Mobile banking app 2. Internet banking | +852 3768 6888 | |

| CMB Wing Lung Bank Limited | 1. Mobile banking app | 1. +852 2309 5555 2. +86 4008 822388 (Mainland) | |

| Dah Sing Bank, Limited | 1. Mobile banking app 2. Internet banking | +852 2828 8168 | |

| Hang Seng Bank, Limited | 1. Mobile banking app | +852 2822 0228 | |

| HongKong and Shanghai Banking Corporation Limited (The) | 1. Mobile banking app 2. Internet banking | 1. +852 2233 3033 (HSBC Premier Elite customers) 2. +852 2233 3322 (HSBC Premier customers) 3. +852 2233 3000 (Other Personal Banking customers) 4. +852 2748 8288 (HSBC Commercial Banking customers) | |

| Industrial and Commercial Bank of China (Asia) Limited | 1. Mobile banking app | +852 2189 5588 | |

| Mox Bank Limited | 1. Mobile banking app | +852 2888 8228 | |

| Nanyang Commercial Bank, Limited | 1. Mobile banking app 2. Internet banking | +852 2616 6628 | |

| Public Bank (Hong Kong) Limited | 1. Mobile banking app 2. Internet banking | +852 8107 0818 | |

| Shanghai Commercial Bank Limited | 1. Mobile banking app | +852 2818 0282 | |

| Shanghai Pudong Development Bank Co., Ltd. | 1. Mobile banking app | +852 2996 5600 | |

| WeChat Pay Hong Kong Limited | 1. Mobile banking app | +852 3929 1666 | |

| ZA Bank Limited | 1. Mobile banking app | +852 3665 3665 |

Mainland

| Name of participating institutions | Service enquiry hotlines | WeChat customer service |

| Agricultural Bank of China Limited | +86 10 95599 | Please refer to Chinese version. |

| Bank of China Limited | +86 10 95566 | Please refer to Chinese version. |

| Bank of Communications Co., Ltd. | +86 10 95559 | Please refer to Chinese version. |

| China CITIC Bank Corporation Limited | +86 10 84518858 | Please refer to Chinese version. |

| China Construction Bank Corporation | +86 10 95533 | Please refer to Chinese version. |

| China Everbright Bank Co., Ltd. | +86 10 95595 | Please refer to Chinese version. |

| China Guangfa Bank | +86 4008308003 | Please refer to Chinese version. |

| China Merchants Bank Co., Ltd | +86 755 95555 | Please refer to Chinese version. |

| China Minsheng Banking Corp., Ltd | +86 10 95568 | Please refer to Chinese version. |

| Fubon Bank(China)Co.,Ltd. | +86-21 962811 | Please refer to Chinese version. |

| Industrial and Commercial Bank of China Limited | +86 10 95588 | Please refer to Chinese version. |

| Industrial Bank Co., Ltd. | +86 21 38769999 | Please refer to Chinese version. |

| Ping An Bank Co.,Ltd | +86 755 95511 | Please refer to Chinese version. |

| Shanghai Pudong Development Bank Co., Ltd.3 | +86 21 95528 | Please refer to Chinese version. |

Note:

1. Arranged in alphabetical order by the English name of the participating institutions.

2. The information related to channels supported, website links, service enquiry hotlines, and WeChat customer service are provided by the bank concerned.

3. Only supports Southbound (The Mainland to Hong Kong) P2P Remittance.